THANK YOU FOR DOWNLOADING

Learn More

If you would like to hear more from Orbitas, including updates on our analysis and resources, please subscribe here.

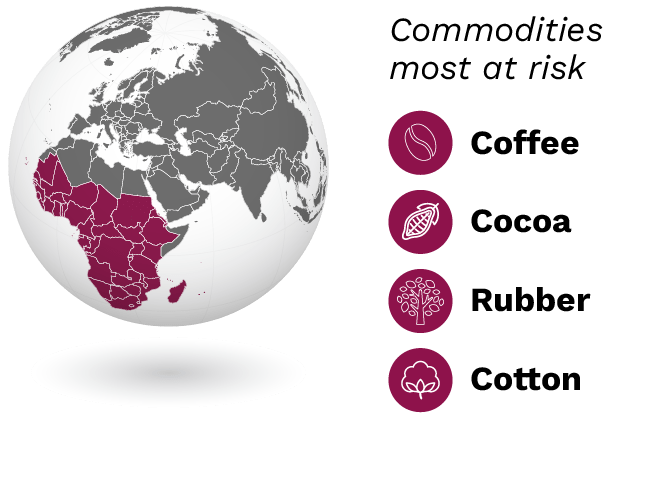

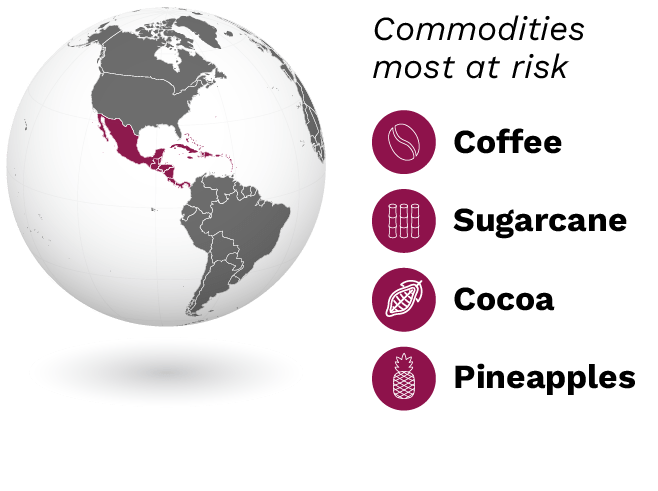

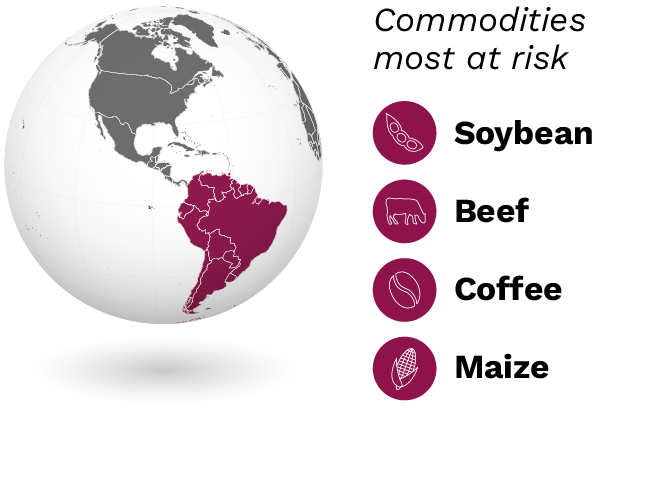

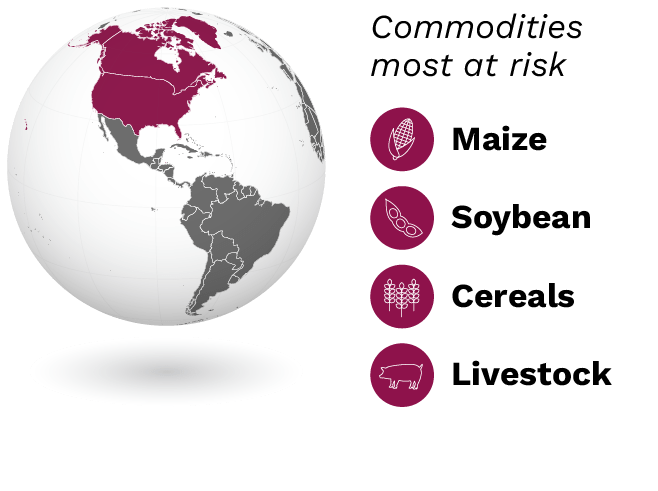

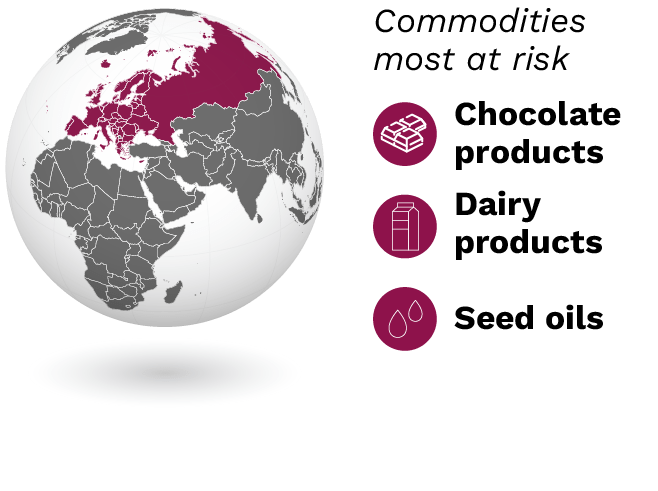

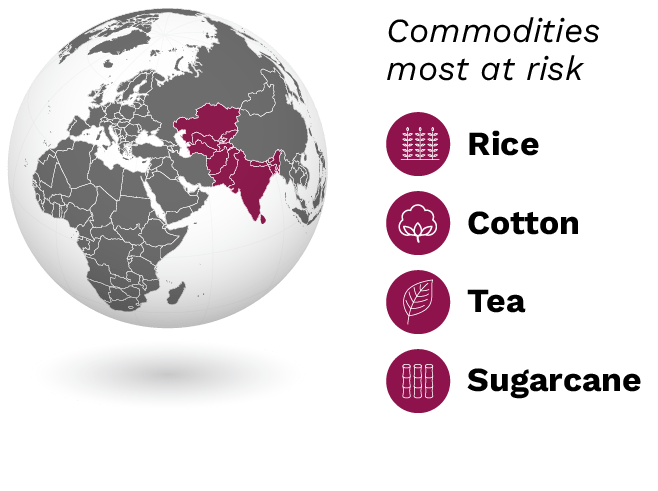

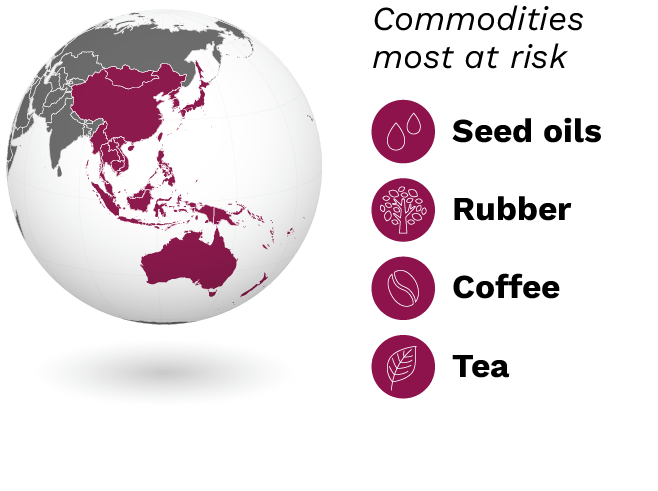

Regions around the world and different commodities face different forms of risk from Climate Transitions, and conversely different opportunities, based on how market power is concentrated. Regions with higher concentration (fewer companies) responsible for upstream production of commodities face higher risks that they will encounter greater policy and legal challenges.

These are often driven by foreign regulators and importers restricting market access for emission-intensive or deforestation-linked commodity products. An example of this type of risk in the real world includes the European Deforestation Regulation (EUDR). By contrast, regions where concentration in the market sits with a few downstream processors are less directly affected by policies and regulations focused on preventing high-emissions commodity production.

However, these regions are more exposed to significant reputational risks. These risks come about when downstream processor brands are associated with unsustainable suppliers and regulators increasingly adopt stricter rules. This can be seen in action today where policymakers are requiring disclosure of Scope 3 value chain emissions. Since Scope 3 emissions encompass the full range of emissions from the supply chain to end-use activities, processors whose suppliers rely on unsustainable production methods face greater reputational risks of losing market share or even seeing divestment.

Regional variation in water and electricity access, internet availability, the physical impacts of climate change, as well as in social and political dynamics, will likely further shape the ways the global response to climate change is felt. In some cases, they pose greater challenges for FLAG sector businesses and investors looking to mitigate financial risks from climate change. In other cases, they pose challenges for creating opportunities.

FLAG sector investors and businesses who aim to capitalize on the opportunities presented by the societal response to climate change, known as Climate Transitions, and minimize their exposure to associated risks must keep these differences in mind as they craft investment strategies and make business decisions.

A clear example of regional variances in Climate Transition risks are the reputational and legal risks for retailers associated with tropical deforestation. There is perceived greater risk when sourcing products from South America, Central Africa, and parts of Asia and Oceania but not when sourcing from North America or Europe. These risks often center around the higher rates of deforestation that occur in these regions, ignoring the historical deforestation that occurred in North America and Europe in the Industrial Age.

Another example is crop burning, a practice prevalent in some regions in Central America, South and Central Asia, and elsewhere. Crop burning releases black carbon, a powerful warming agent, and contributes significantly to regional air pollution and associated adverse health outcomes. Retailers should consider preferentially sourcing from suppliers who avoid this practice, and investors can reward retailers who do so.

Below is a summary of key climate transition risks by region, primarily driven by the emission intensity of top commodities and the actions of investors, supply chains, regulators, consumers and civil society.