Climate-Related Financial Regulation Explorer

As the financial and economic impacts of climate change are becoming better understood, a number of governments have taken steps to foster greater transparency, including through adopting mandatory climate risk disclosure and supply chain due diligence. With climate change risks to companies and financial sector expected to continue to rise in coming years, more governments are expected to tighten regulations around disclosure and due diligence. In this ever-evolving landscape, this interactive online platform will provide up-to-date information on existing and emerging regulatory regimes and due diligence laws around the world.

Updated as of April 2025.

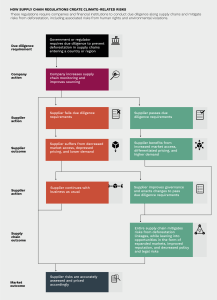

More about supply chain due diligence

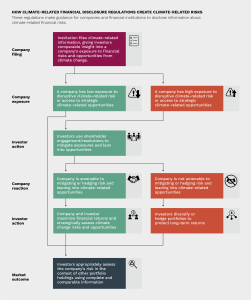

More about climate risk disclosure

Mandatory climate risk disclosure is becoming part of the rapidly changing regulatory landscape. The new requirements have the potential to significantly change how public companies measure, report, and address risks from climate change. The purpose behind many of the new disclosure requirements are to help companies mitigate financial and physical risks from climate change, while also creating frameworks for clear, consistent, and comprehensive climate-related information that are useful to investors. Many of the required standardized disclosures that have been adopted are in line with the Task Force on Climate-Related Financial Disclosure (TCFD), which in 2017 provided recommendations for transparency around government, strategy, risk management, and metrics/targets.

Mandatory climate risk disclosure is becoming part of the rapidly changing regulatory landscape. The new requirements have the potential to significantly change how public companies measure, report, and address risks from climate change. The purpose behind many of the new disclosure requirements are to help companies mitigate financial and physical risks from climate change, while also creating frameworks for clear, consistent, and comprehensive climate-related information that are useful to investors. Many of the required standardized disclosures that have been adopted are in line with the Task Force on Climate-Related Financial Disclosure (TCFD), which in 2017 provided recommendations for transparency around government, strategy, risk management, and metrics/targets.