THANK YOU FOR DOWNLOADING

Learn More

If you would like to hear more from Orbitas, including updates on our analysis and resources, please subscribe here.

Scenario analysis is a critical building block for assessing climate transition risks. Orbitas, in partnership with Vivid Economics, has published Transition Scenarios for Tropical Commodities, which presents the results of our macroeconomic scenarios for tropical commodities.

Our findings project six major shifts between now and 2050:

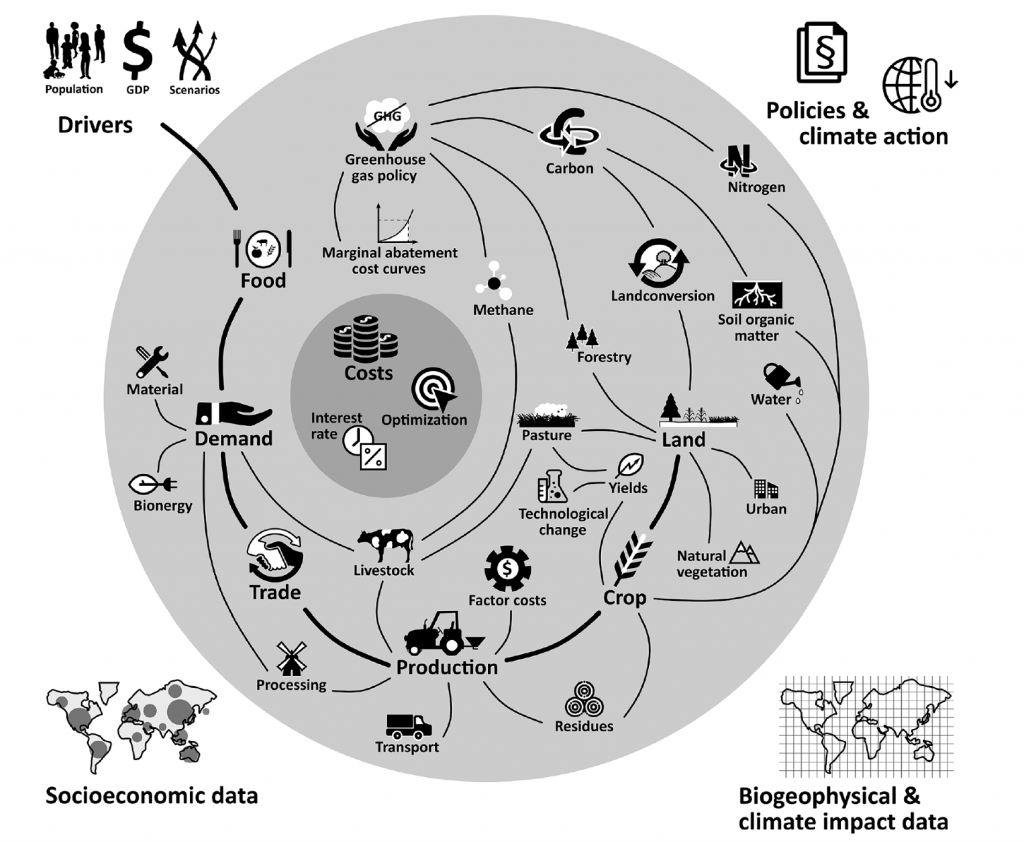

Following the footsteps of the New Zealand government, the UK government signaled its intention to mandate climate disclosures as recommended by the Task Force on Climate-related Financial Disclosures (TCFD). One of the key recommendations outlined by the TCFD working group is to assess climate risk using scenario analysis, a technique long used in climate science. Scenario results are generated using Integrated Assessment Models (IAM’s). The integrated nature is derived from the fact that these methods model knowledge from different disciplines and combine them with how human development and societal choices interact in a ‘combined’ system.

How Integrated Assessment Models Work – MAgPIE Integration Diagram

While these models form the backbone of climate change modeling (the results are assessed in IPCC reports), their utility has been mainly to evaluate the technical and economic feasibility of climate policies or targets. This makes it difficult to answer more granular questions, such as: what does a 1.5C temperature increase mean for a specific region, a specific industry, or even a specific company.

Orbitas’ objective is to assess transition risks for tropical commodities such as beef, palm oil and soy. The critical first step is to offer macroeconomic scenarios that project what changes we would expect as climate responses accelerate.

Orbitas partnered with Vivid Economics, who played an invaluable role in developing the Inevitable Policy Response scenarios in partnership with the Principles of Responsible Investment. Using the Potsdam Institute for Climate Change’s (PIK) open-source Model of Agricultural Production and its Impact on the Environment (MAgPIE), a spatially explicit partial equilibrium model, Orbitas generated five climate transition scenarios spanning 1.5-4oC temperature paths. This report presents the findings of these scenarios.

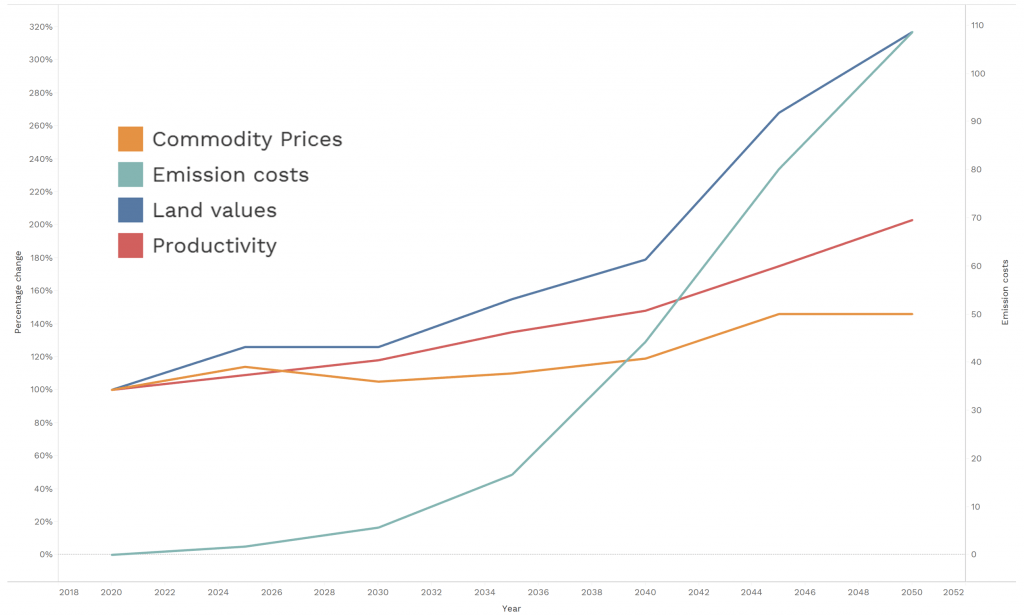

Projected productivity, land values, commodity prices and emissions costs – Aggressive Scenario

How will the tropical commodity sector perform in an increasingly constrained economic and biophysical ecosystem? We conclude that current business models in the global agricultural sector are inconsistent with the future our scenarios project. To survive these transitions, and indeed, to thrive under these conditions, we identified a set of industry shifts that must happen if businesses are to thrive under climate transitions. Download the full report to learn about these shifts and how businesses can strategically plan to remain competitive across these scenarios.

DOWNLOAD REPORT

MAgPIE, just as other integrated assessment models, offer a broad vision of projected shifts. To quantify risks more granularly, outputs from such models have to be translated so they are applicable to specific countries, industries and even companies. Orbitas is doing just that. MAgPIE global modeling is just the first step in a groundbreaking methodology with the purpose of quantifying climate transition risks for agricultural companies operating in tropical countries. We will release the results of our analysis in December.

ABOUT VIVID ECONOMICS

Vivid Economics is a leading strategic economics consultancy with global reach. We strive to create lasting value for our clients, both in government and the private sector, and for society at large. We are a premier consultant in the policy-commerce interface and resource- and environment intensive sectors, where we advise on the most critical and complex policy and commercial questions facing clients around the world. The success we bring to our clients reflects a strong partnership culture, solid foundation of skills and analytical assets, and close cooperation with a large network of contacts across key organizations.