Brazil’s Cattle Sector Amidst Climate Transitions

Brazil’s cattle sector is set to transform as climate transitions spur new action to reduce emissions. Analyzing the potential impacts of climate action on this critical sector reveals material financial risks alongside opportunities to invest in a more sustainable and efficient future for cattle production.

Brazil’s Cattle Sector Amidst Climate Transitions

Brazil’s cattle sector is set to transform as climate transitions spur new action to reduce emissions. Analyzing the potential impacts of climate action on this critical sector reveals material financial risks alongside opportunities to invest in a more sustainable and efficient future for cattle production.

Climate Change is Shaping the Future of Brazil’s Cattle Sector

Even in a world that limits global warming to below 2°C, government, consumer, and private sector responses to climate change, known as “climate transitions”, will materially change the financial future of the Brazilian cattle sector.

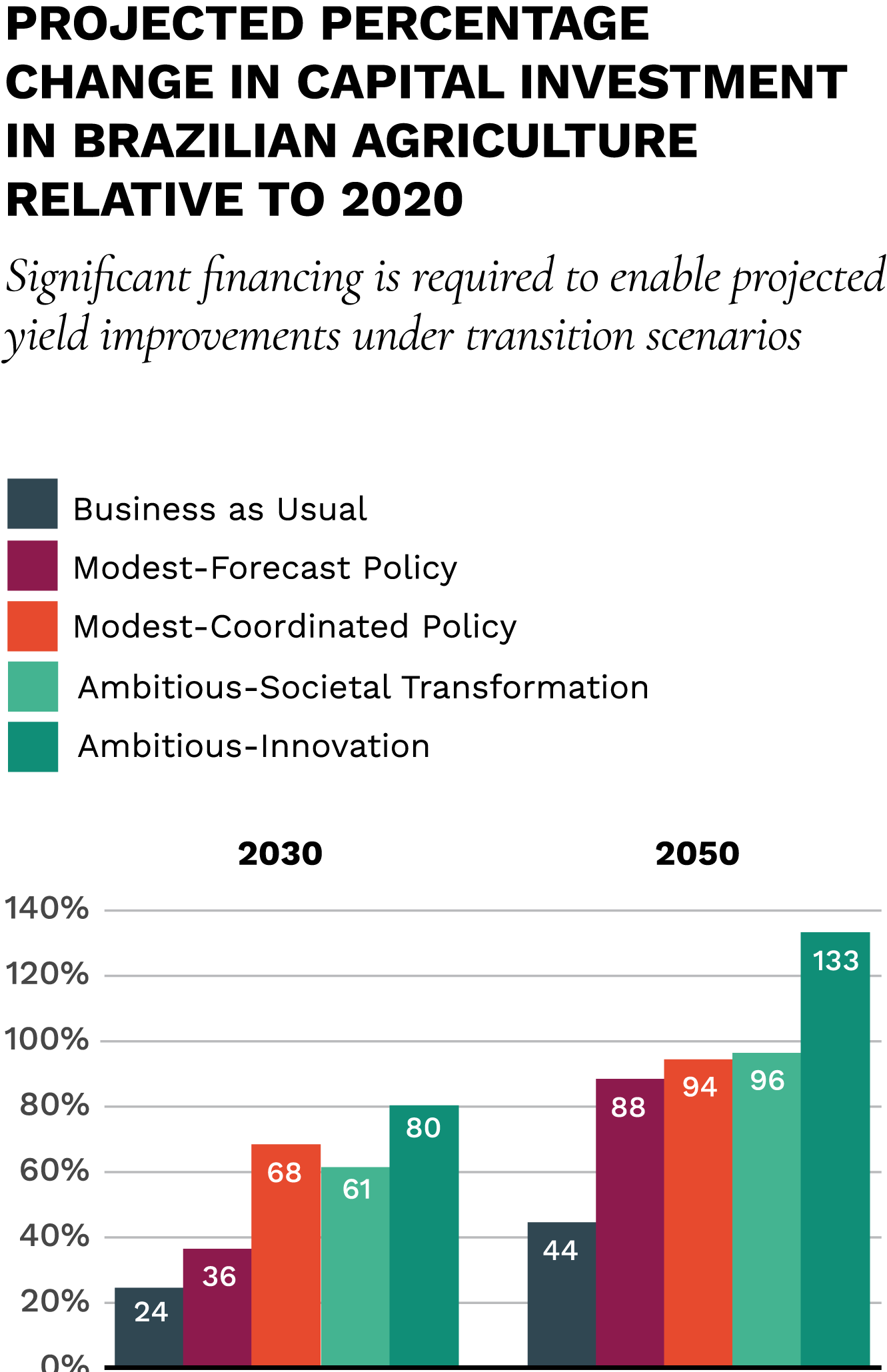

Analysis of Brazil’s cattle sector shows that the risks posed by maintaining current production practices and business models are material for investors, producers and the sector’s entire value chain. Yet climate transitions also open significant new opportunities for producers and investors who stand to benefit from a projected 88 percent increase in agricultural investment by 2050.

Climate Change is Shaping the Future of Brazil’s Cattle Sector

Even in a world that limits global warming to below 2°C, government, consumer, and private sector responses to climate change, known as “climate transitions”, will materially change the financial future of the Brazilian cattle sector.

Analysis of Brazil’s cattle sector shows that the risks posed by maintaining current production practices and business models are material for investors, producers and the sector’s entire value chain. Yet climate transitions also open significant new opportunities for producers and investors who stand to benefit from a projected 88 percent increase in agricultural investment by 2050.

Climate Transition Impacts on Brazil’s Cattle Sector by 2050

Climate transitions will create risks and opportunities that disrupt business models and create volatility in the future. Those who invest in sustainable efficiency improvements and diversify revenue streams can improve their financial resilience and maintain competitiveness amidst these changes.

%

Possible increase in capital investment in Brazilian agriculture by 2050, driven by financing of deforestation-free and low-emission products under climate transitions — a potential USD 157 billion opportunity

%

Possible increase in capital investment in Brazilian agriculture by 2050, driven by financing of deforestation-free and low-emission products under climate transitions — a potential USD 157 billion opportunity

%

Possible decrease in available pastureland in Brazil compared to 2020 levels, an area larger than the size of Afghanistan.

%

Possible decline in Brazilian beef production by 2050 compared to 2020 levels.

%

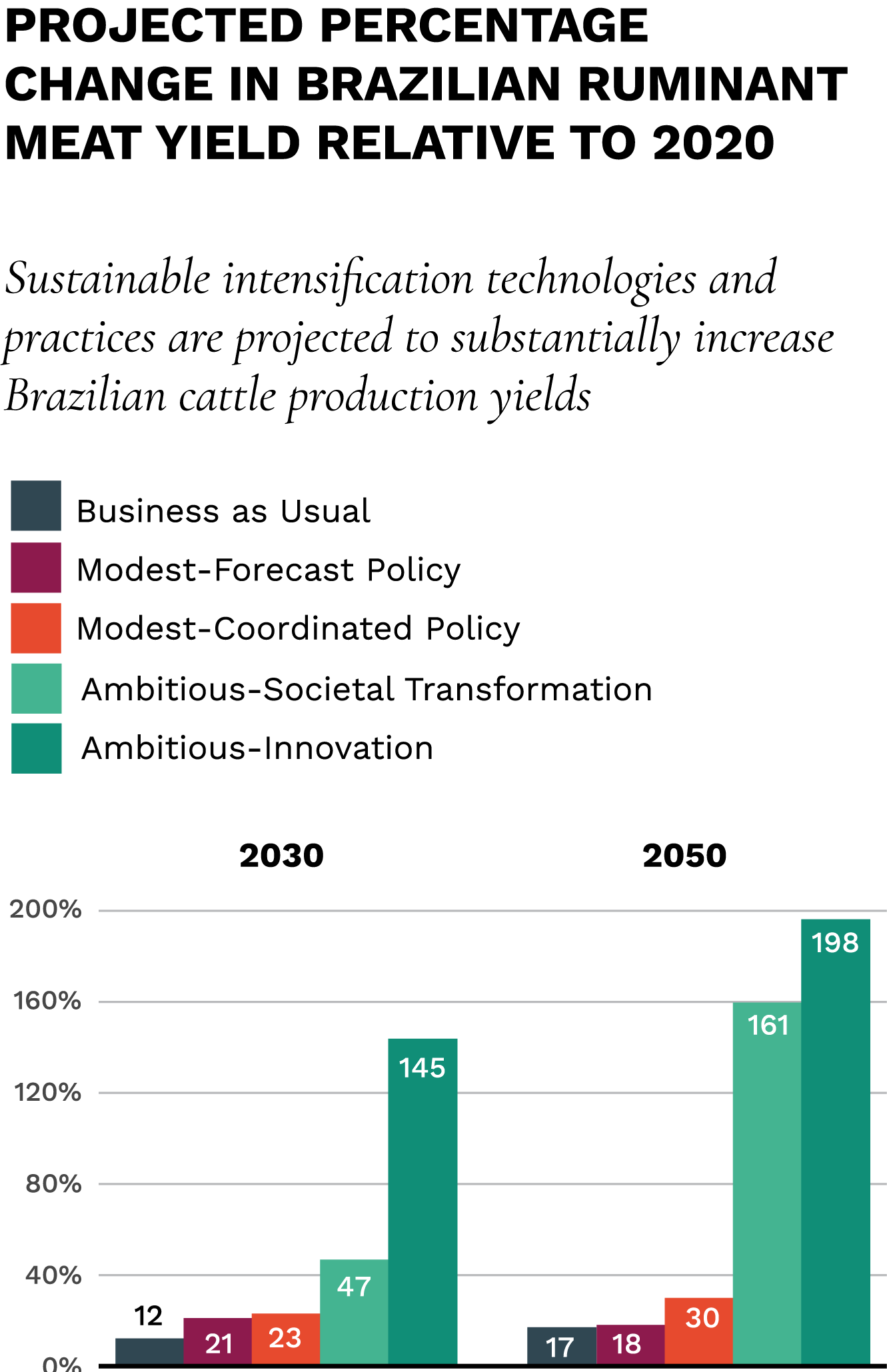

Possible increase in average yield per hectare for Brazilian cattle farmers compared to 2020 levels.

%

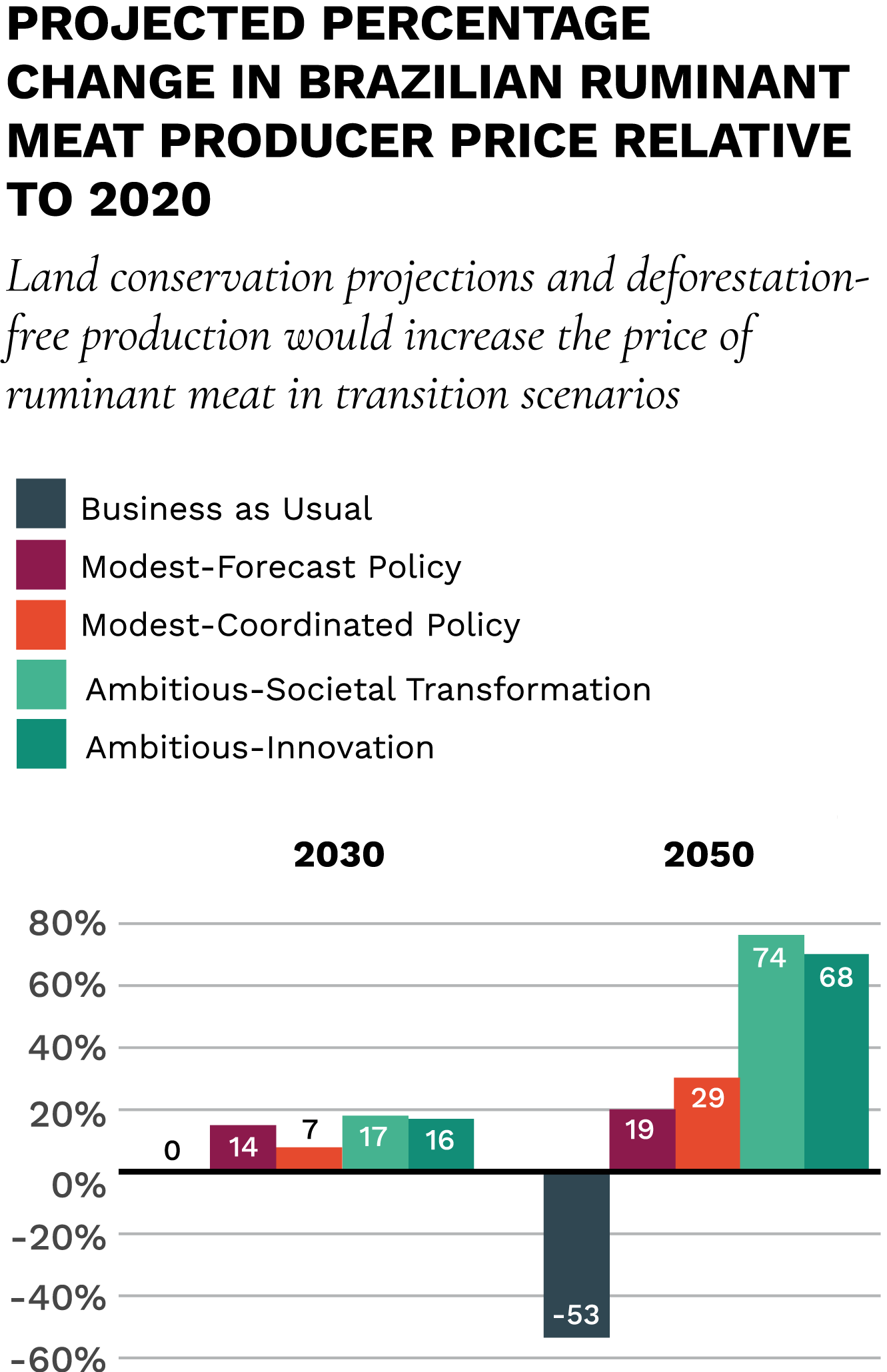

Possible increase in beef prices for producers compared to 2020 levels.

As projected in the below 2°C-aligned Modest-Forecast Policy scenario.

See The 7 Trends Driving Climate Transitions For Brazil’s Cattle Sector

1. Emissions pricing

Greenhouse gas emissions pricing could materially drive up production costs for emission-intensive cattle producers and create opportunities to diversify revenue streams.

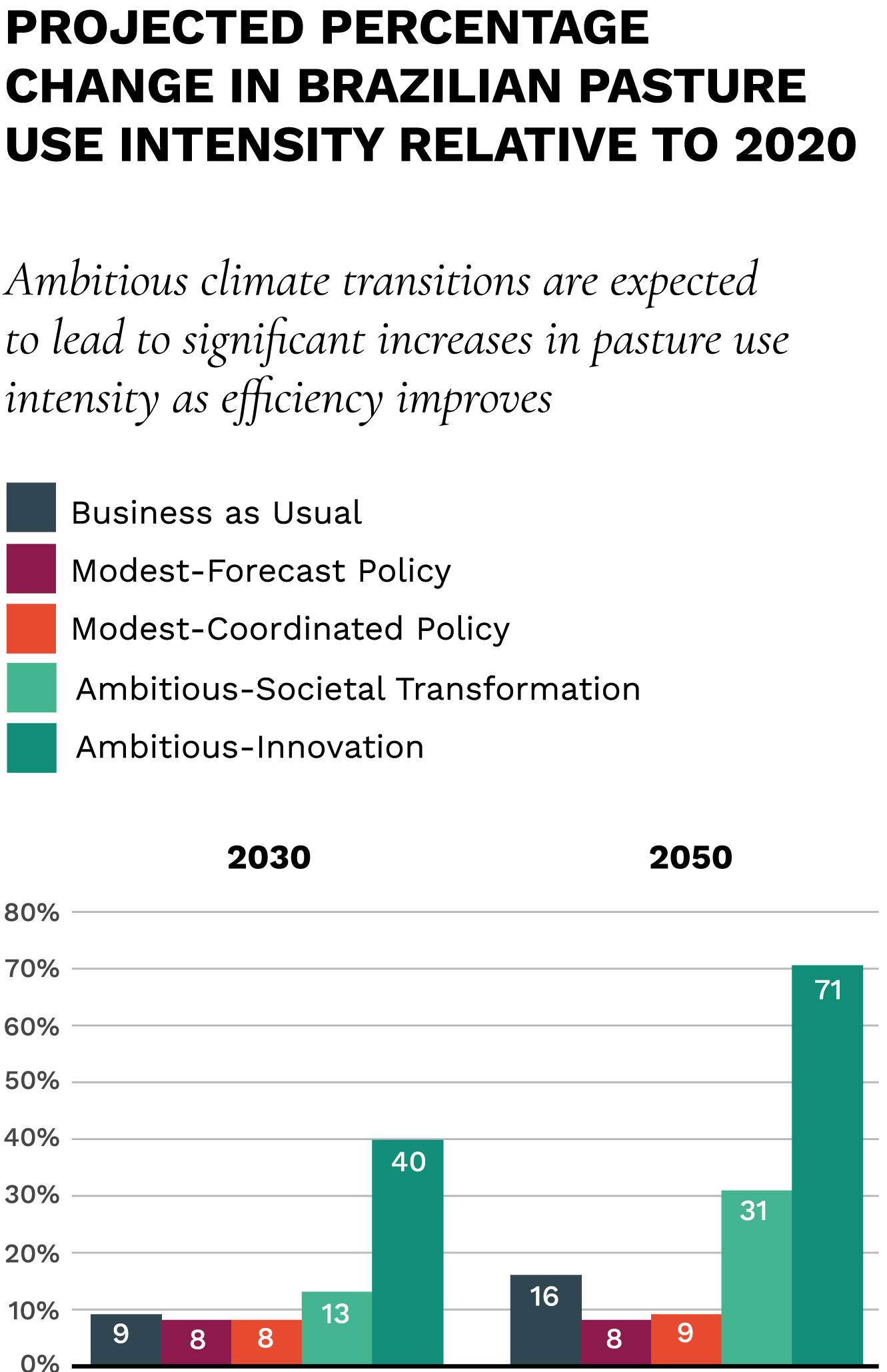

2. Land constraints

Climate action, land conservation measures and competition for land from the bioeconomy could reduce the availability of affordable pasture land.

3. Yield improvements

As business models reliant on high land use and deforestation become less feasible, cattle farmers can prioritize sustainable productivity investments and process improvements to boost yield on existing land and on degraded pastures.

4. Accelerating investment

Investment in capital goods, land, advanced technology adoption and improved management practices could increase production efficiency.

5. Beef price fluctuations

Climate transitions could create producer price increases for deforestation-free and low-emission cattle products globally, presenting opportunities for producers that increase productivity and provide transparency to buyers and financiers.

6. Dietary shifts

Evolving global dietary trends could threaten demand for beef and other cattle products under climate transitions, as the growth in sustainable-minded consumers increases demand for protein alternatives and low-emission beef.

7. Growing exports

Export markets are likely to become increasingly important due to Brazil’s competitive advantage in beef production, although regulations promoting source of origin disclosure will restrict market access for deforestation-linked beef.

Brazil’s Cattle Sector at A Climate Change Crossroads

The Brazilian cattle sector is vital to Brazil’s economy, employing 3.3 million people across the nation and contributing to nearly 10 percent of the nation’s GDP. Yet, cattle production is also responsible for 16 percent of Brazil’s greenhouse gas emissions. When linkages to land use change are taken into consideration, as much as 79 percent of Brazilian food emissions may be associated with beef production, making emission reductions vital to achieving Brazil’s domestic climate agenda.

Brazil has set ambitious goals to end deforestation and to earn a reputation as a climate leader on the world stage ahead of the 2025 UN Climate Change Conference COP30 when Brazil will be the host and figurehead for driving global climate action. Additional pressures from international governments, investors, corporates and other actors are shifting the financial outlook for Brazilian cattle in pursuit of a deforestation-free and low-emission future.

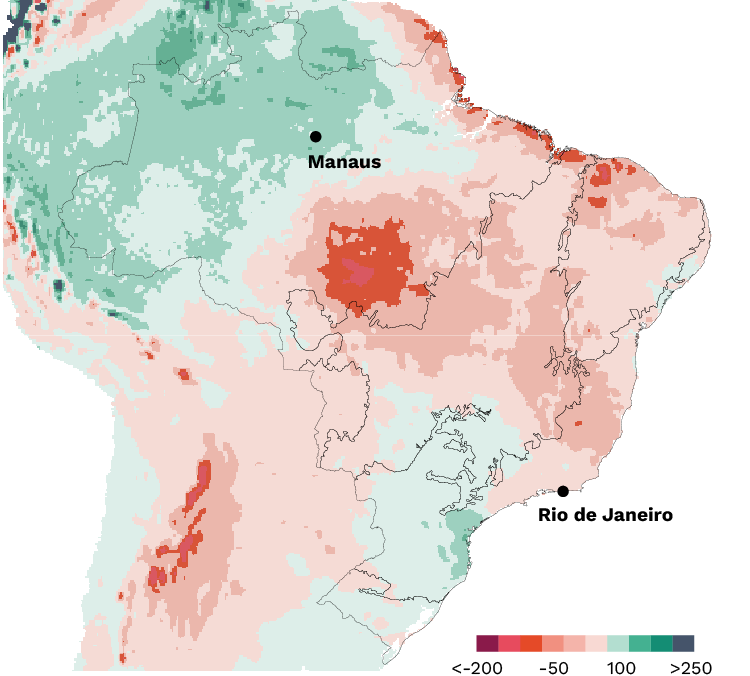

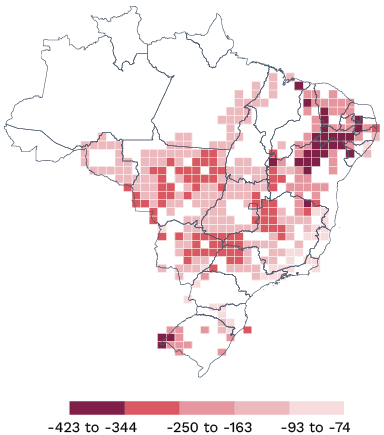

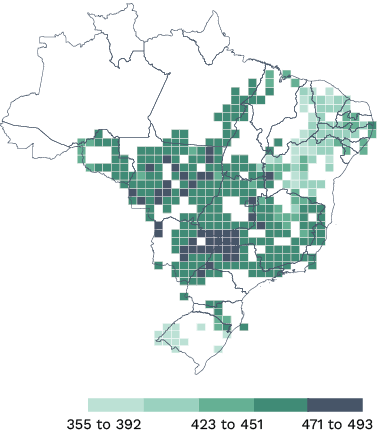

Changes in Rainfall (mm)

(Between 1961-1990 and 1991-2020)

Physical Climate Risks Intensify Climate Transitions

Brazil’s agricultural sector has experienced worsening physical climate change impacts for the past several years, impacting both yields and operating costs. These impacts spur action in the form of climate transitions.

Physical climate risks are well known to Brazil’s agricultural sector, as the financial implications of extreme weather conditions materialize. For example, broad shifts in atmospheric conditions critical to agricultural productivity are threatening the availability of water in areas responsible for 35 to 55 percent of cattle production.

The wide-ranging impacts on livelihoods, food security, natural resources and health brought on by physical climate change risks make accelerating climate transitions inevitable. The only unknown is the speed and scale of these transitions.

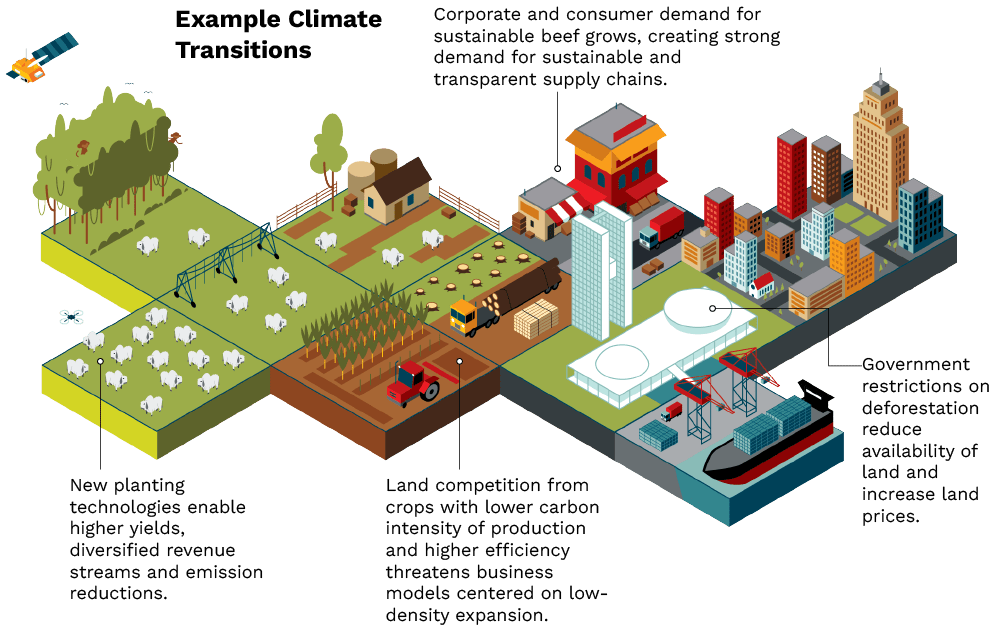

Understanding Climate Transitions for Brazil’s Cattle

Climate transitions cover a diverse range of drivers that will transform the future of the global economy.

Across a wide range of climate transition pathways, economic and financial models reveal that achieving greater production efficiency and higher sustainability standards could help producers in the Brazilian cattle sector to withstand economic shocks and to capture projected producer price increases.

Financial risks will increase for many producers, but investments in production efficiencies, sustainable management practices, diversifying revenue streams and transitioning to other land uses to increase earnings can create economic resilience across Brazil.

Learn More About What Climate Transitions Are

‘Climate change and the actions taken to mitigate its impacts, known as climate transitions, represent some of the largest systemic changes our economies have ever seen. ‘Climate transitions’ refer to shifts in domestic policy, consumer preference, international regulations, competition driven by technology and other market demands for sustainability that will transform the future of the global economy, especially across the Brazilian cattle sector. Climate transition risks – legal and policy, technology, market and reputation – are all potential pitfalls that can impact performance and are increasingly critical to address, and they all present corresponding opportunities for market leaders.

For Brazil, new anti-deforestation policies, international trade and sustainability standards and corporate or investor net-zero goals all contribute to transitioning the cattle sector towards a new paradigm stakeholders must proactively manage. Learn more about specific climate transitions impacting Brazil’s cattle sector in our report.

Climate Transition Scenario Analysis for Brazil’s Cattle Sector

Orbitas applies a range of potential future climate transition scenarios with varying levels of ambition to inform stakeholders where risks and opportunities exist.

Orbitas uses scenarios aligned with 1.5°C and 2°C of warming to showcase the potential impacts that climate transitions may have upon the Brazilian cattle sector and reflect how different levels of climate action can create material financial risks and opportunities.

Learn More About Orbitas Scenario Analysis

We use several different scenarios to showcase the potential impacts that climate transitions may have upon the Brazilian cattle sector and reflect how different levels of climate action can create material financial risks and opportunities. To help Brazilian cattle producers and investors understand the scale of impacts from climate transitions, this report highlights a plausible reference scenario aligned with keeping global warming below 2°C.

This models the impact of forecasted climate policies and actions on the real economy up to 2050, tracing detailed effects on producer prices, crop yields, and rates of deforestation. This scenario, the Forecast Policy Scenario, is aligned with the Inevitable Policy Response initiative developed by the UN-supported Principles for Responsible Investment. These principles have been signed by investors with over USD 121 trillion in assets under management.

This report analyzes how different types of climate transitions will impact critical financial outcomes for the cattle sector’s producers, investors, buyers and other stakeholders. See the potential outcomes for the Brazilian cattle sector across the following:

- Future prices for cattle producers

- Changes in available pastureland

- Changes in Brazilian cattle exports

- Improvements in yield per hectare

- Increases in returns with investments in soil restoration

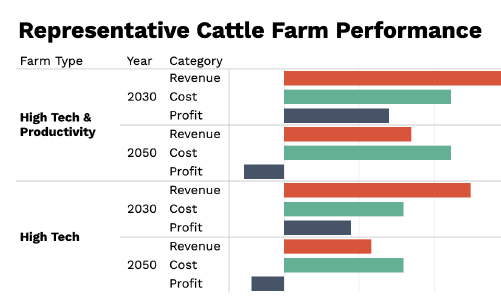

- Profitability for different types of cattle producers

- Profiles of cattle producers most and least-likely to experience financial losses

- And more

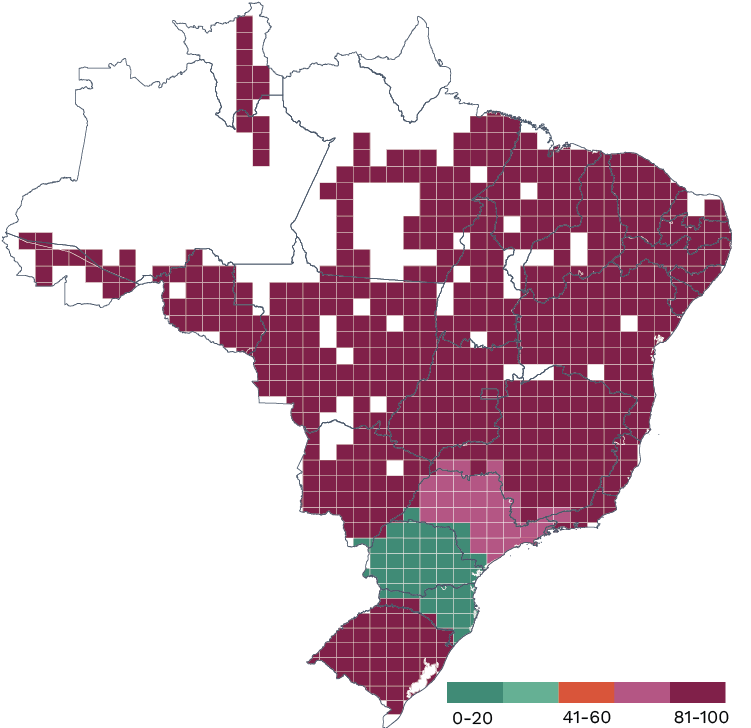

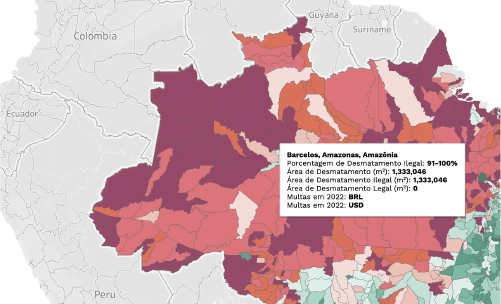

Likelihood of financial loss with economic shocks to beef prices and transportation costs

Identifying Where and Who Climate Transition Risks and Opportunities Could Impact

Orbitas analysis of Brazilian cattle production also shows how different regions, types of producers and solutions can impact the financial future of stakeholders.

Applying potential price shocks to producers across Brazil showcases who could face outsized risks as different types of climate transitions occur. Producers that have low levels of production efficiency, higher costs for transporting products to market and those that have ties to illegal deforestation face the most risk.

On the other hand, proven improvements to production efficiency may even provide market leaders financial gains through new opportunities driven by climate transitions.

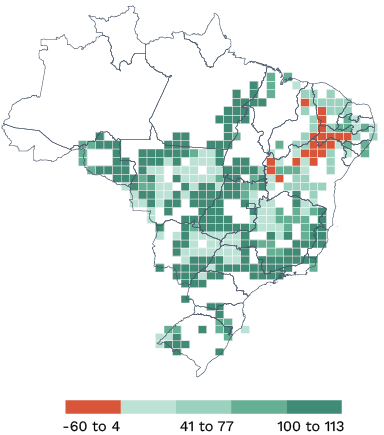

Profitability of cattle production systems before, during and after restoration

Profitability over time in USD per hectare

Moderate to severe degradation

Initial investments in restoration

Maintenance phase after restoration

Learn More About Orbitas Analysis of Risks and Opportunities

EMERGING RISKS

The profitability of cattle production varies significantly across Brazil. On average, more efficient and technologically advanced systems in the south of Brazil outpace smaller, less-efficient producers in the north. This profitability dynamic, and other factors, are applied through Orbitas economic tools to see how climate transition impacts will create risks that the sector will have to contend with.

SUSTAINABLE OPPORTUNITIES

Brazilian cattle farmers can proactively adopt technology and management solutions that increase financial resilience to climate transitions and diversify revenue streams. Low-cost techniques include pasture management practices, increased fertilizer efficiency and use and sustainable farming methods, such as integrated crop-livestock-forest systems and silvopasture. Investments in these new opportunities serve as both proactive mitigation of climate transition related risks to prevent financial losses, and as ways to capitalize on growing demand for low-emission, deforestation-free and cost-competitive beef. Regenerative soil restoration practices, for example, could increase the per hectare yield of severely degraded pastures by up to 310 percent, raising profitability by over USD 375 (~BRL 1875) per hectare for the lowest productivity producers today.

NEW MARKET OPPORTUNITIES

There are growing markets for other land use practices that can transform degraded pasture land into profitable assets to diversify revenue opportunities across rural Brazil. Additional revenue streams include agroforestry and non-timber forest products and carbon markets as GHG prices grow. Download the report for more details on these new markets and how Brazil’s cattle sector can proactively manage risks and opportunities.

Brazil’s Cattle Leaders Have the Chance to Make Climate Transitions Work for Them

Climate change and the coming transitions in the global economy provide an opportunity for new market leaders to emerge in Brazil’s cattle sector.

See the full report to learn more and check out Orbitas’ suite of online tools to better understand climate transitions and their impacts.

Report: Brazil’s Cattle Sector

Analysis of Brazil’s cattle sector shows that the risks posed by maintaining current production practices and business models are material for investors, producers and the sector’s entire value chain.

Cattle Sector Analyzer

Use this tool to understand the material risks and opportunities associated with climate transitions and the financial risks associated with potential shocks to yield, transportation costs and product prices that cattle farmers are likely to encounter between now and 2050.

Illegal Deforestation Analyzer

Use this tool to examine the distribution of illegal deforestation risk and enforcement fines across the Amazônia, Cerrado and Pantanal biomes in Brazil.

*Note: The material produced by Orbitas is provided for informational purposes only and should not be construed as investment advice.

This report was produced with financial support from the Children’s Investment Fund Foundation (CIFF) and facilitation by Nature Finance.

Want to learn more?

Sign up for our latest news, thoughts, and insights.