THANK YOU FOR DOWNLOADING

Learn More

If you would like to hear more from Orbitas, including updates on our analysis and resources, please subscribe here.

Author: Kyle Saukas

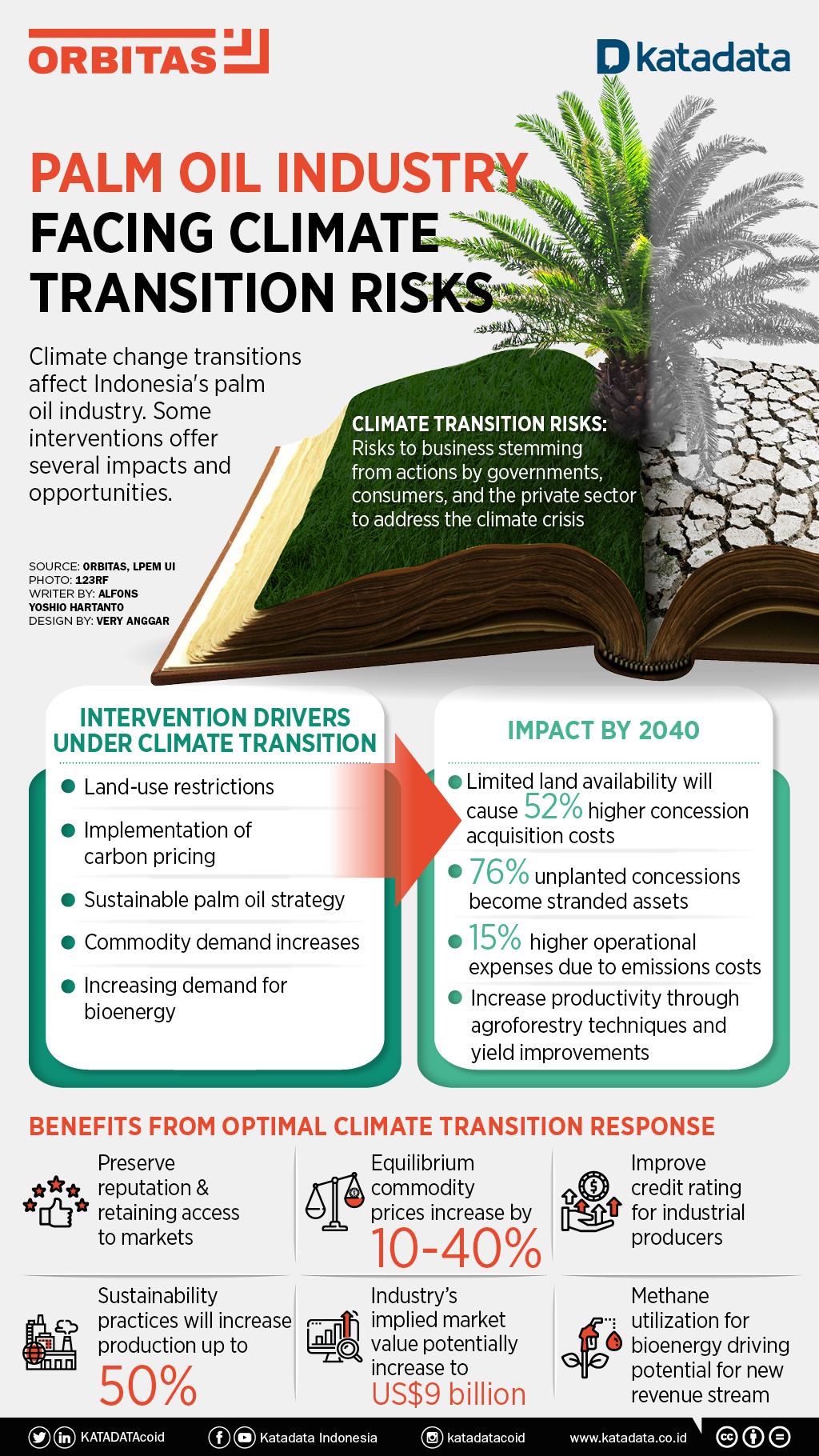

Climate transition risks include the increase in concession fees, the emergence of stranded assets, and the increase in operational costs

Climate transition risks will affect various industrial sectors in Indonesia, including palm oil. Orbitas specifically studies the impact of climate change on capital and financial institutions to map out the impacts and benefits that may occur as a result of the climate transition. Looking at the current conditions, Orbitas sees that there will be several drivers of climate transitions that could have an impact on the operations of palm oil companies.

Major drivers can include the implementation of carbon prices, policies limiting land use, sustainable corporate palm oil strategies, increasing demand for commodities like palm oil, and increasing bioenergy demand. Several of these efforts are underway and others aimed at addressing the climate change will create transitions in the industry. By 2040 there will be direct impacts on the palm oil industry. Restrictions on land expansion could spur an increase in concession fees by up to 52 percent. Meanwhile, there is the potential for 76 percent of unplanted concessions in Indonesia to become stranded assets. Meanwhile, the existence of emission costs is expected to spur an increase in operational costs by up to 15 percent. Interestingly, the palm oil industry is also predicted to respond to the climate transition by increasing productivity through agroforestry.

Climate transitions also have the potential to provide benefits if producers and financiers act optimally. The reputation and market access of the national palm oil industry will improve, and the credit ratings of industrial producers will also increase if an environmentally oriented approach is taken. In addition, the equilibrium commodity price is estimated to increase by 10-40 percent in the coming decades and production can also increase up to 50 percent if sustainable practices are implemented.

DOWNLOAD INFOGRAPHIC