Climate change poses an unprecedented threat to the global economy, with its implications resonating across all industries. As governments, corporates, financiers, and customers respond to climate change and begin to transition to a low-carbon future, the changes they implement result in climate transition risks and opportunities.

While climate transition risks are well understood in some sectors, like energy and transportation, the adoption of transition risk and opportunity assessments in the land use sector is moving at a slower pace.

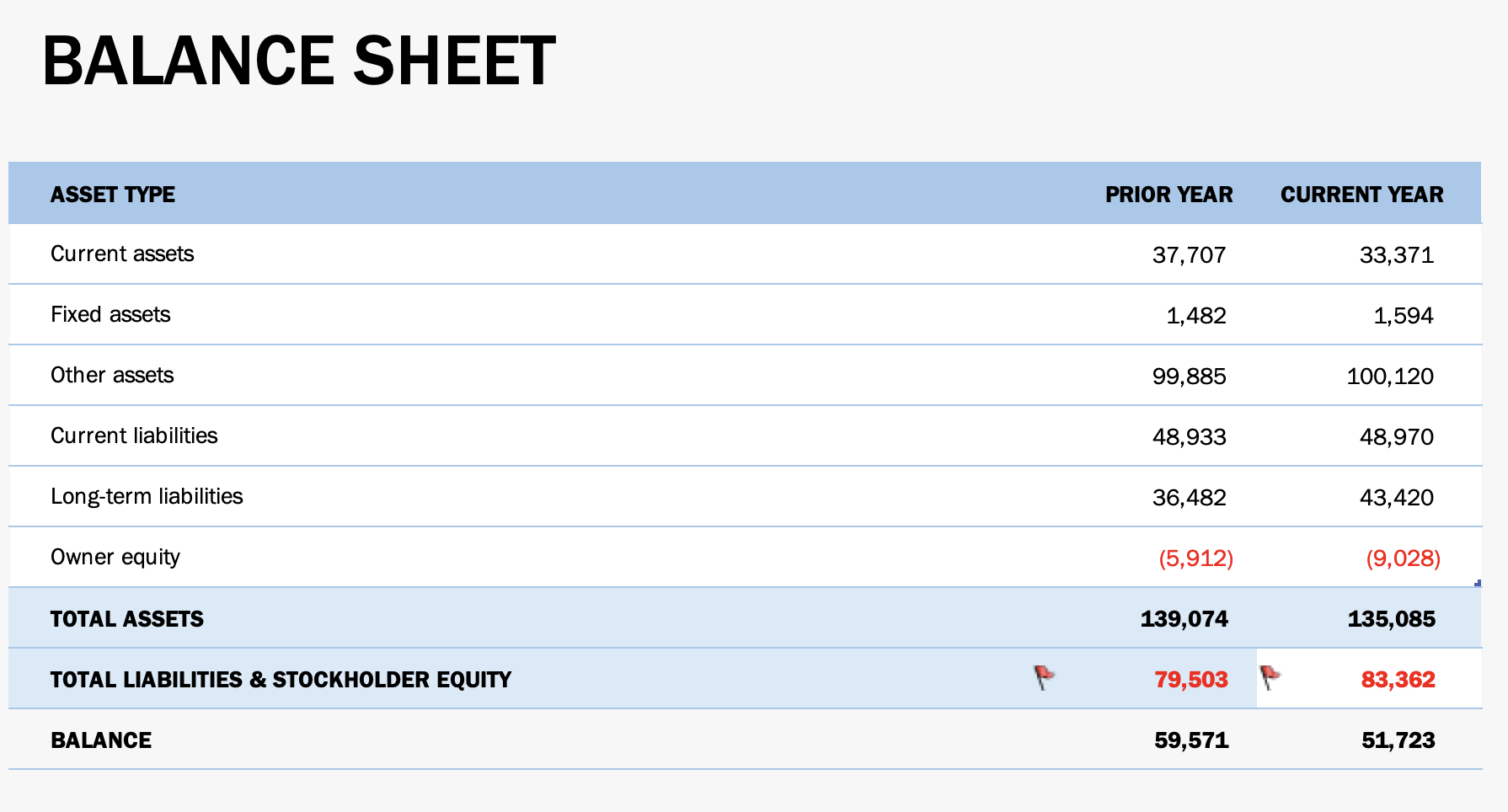

This post explores the four primary categories of climate transition risks in the land sector: regulatory and policy risks, technology risks, market risks, and reputation risks and introduces our Climate Transition Card series designed to help stakeholders understand how climate transitions translate into real-life impacts on company Income Statements and Balance Sheets. Later this year Orbitas will release a digital tool making it easier for investors and companies to track growing climate transitions and their potential impacts in financial reporting using these cards.

Climate Transition Risks in the Land Sector

The land sector, comprising agriculture, forestry, and other land use, is extremely vulnerable to a changing climate. With temperatures rising, extreme weather events like floods, droughts, and heat waves have become more common, leading to unpredictable yields, more years of losses, volatility in the price and availability of commodities, and stranded assets. In addition to these physical risks, the sector is vulnerable to reactions to climate change from producers, customers, financiers, governments, and civil society. The climate transition risks facing the land sector can be categorized broadly into four categories, legal and policy risks, technology risks, market risks, and reputation risks.

Legal and Policy Risks

For example, the European Union Deforestation Free Supply Chain Regulation law requires that companies that sell their products in the EU market or export them from the EU provide a due diligence statement as well as precise geolocation coordinates showing that the commodities and products are deforestation-free. Non-compliant firms will lose access to the EU market. Click the Card to the left to see how this regulation can impact investments.

Technology Risks

For example, as alternative protein technologies improve and are more widely adopted, meats could be substituted by meat alternatives as they become cheaper to make and more affordable. Brazilian cattle small holders that have low-intensity low-yield will be the most exposed to these substitution effect risks and will be less likely to survive demand shocks due to the lack of economies of scale and scope. Click the Card to the left to see how consumer shifts towards alternative proteins and other foods could impact the financial outlook of cattle investments.

Market Risks

For example, during COP26, 10 commodity-centric corporations signed onto the Declaration on Forests and Land Use pact, pledging to end deforestation in their supply chains by 2030. If soft commodity raw material growers in the upstream supply chains refuse to adhere to policies implemented by their buyers, they risk facing sanctions such as suspension of trade, exposing firms to market access risks. Click the card to the left to see how corporate goals to end deforestation can shift the outlook for market access and future financial impacts.

Reputation Risks

For example, the SEC has proposed a rule that could require businesses to disclose to investors how climate change would affect their operations, the financial impact of materialized climate change risks, and importantly, Scope 1, 2, and 3 emissions. This would illuminate climate-related risks to a company’s short medium and long-term health. However, regardless of what the SEC includes in the final ruling anticipated this year, the direction of travel is clear for global companies and their supply chains as regulators around the world increasingly converge on climate-related financial disclosures. These disclosures provide investors with the comparable information needed to inform investment decisions and more accurately assess climate risks and opportunities. Click the card to the left to see how emissions disclosure and reputation impacts could translate into changes in financial reporting. Also, please see our recent report on the financial risks of U.S. imported Scope 3 emissions from deforestation for key tropical commodities.

Each of these risk types has far reaching consequences which ultimately can materially impact public financial statements, leading to further financial, legal, and reputational issues. However, if navigated responsibly, the risks can be turned into opportunities.

Managing Climate Transition Risks

Understanding and mitigating climate transition risks in the land sector is essential for investors and producers to navigate the changing landscape. Here are some strategies to consider:

Stay Informed: Continuously monitor evolving climate-related regulations, technological advancements, market trends, and sustainability standards relevant to the land sector. Orbitas’ Climate Transition Cards are a great way to stay up-to date on the latest climate transition risks and opportunities. The cards are clear, concise and actionable. They provide the most important details about an emerging or existing climate transition risk in the land sector. Sign up here to join our email list and be the first to know about these important risks.

Scenario Analysis: Conduct scenario analysis to assess how different climate outcomes could impact your investments or productions. This helps in identifying vulnerabilities and opportunities. Orbitas has proven that asset-level scenario analysis is feasible and has carried out in-depth analysis on Indonesian palm oil, Colombian cattle, and Peruvian palm oil. We are expanding our geographic and sectoral scope. Our next reports, focused on Brazilian cattle and soy will be published later this year.

Looking Ahead

Climate transition risks in the land sector are increasingly critical for investors to comprehend and address. Legal and policy risks, technology risks, market risks, and reputation risks are all potential pitfalls that can impact performance. However, by staying informed, conducting thorough analyses, and engaging with stakeholders, investors and producers can proactively manage these risks and position themselves for success in a rapidly changing landscape.