THANK YOU FOR DOWNLOADING

Learn More

If you would like to hear more from Orbitas, including updates on our analysis and resources, please subscribe here.

Author: Josh McBee

Despite rising yields, agricultural land use in Brazil has continued expanding—until now. A mix of policy shifts and market forces may finally change that.

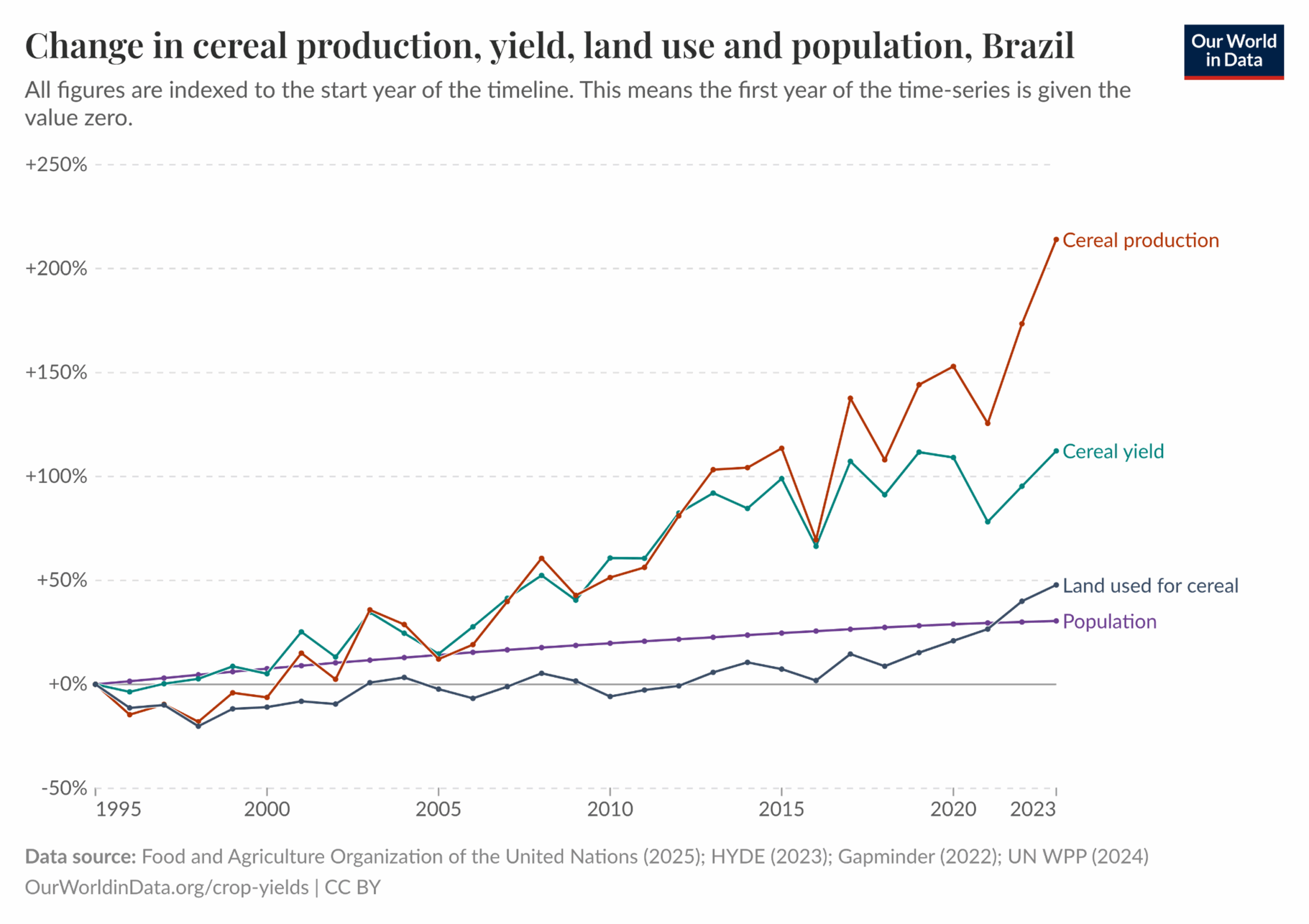

As Brazilian agricultural yields increased significantly over the past several decades (see figure below), farmers grew the same amount of food on less land. In principle, these increases should have led farmers to use less land; in practice, though, agricultural land use has expanded even as yields have increased.

Now, however, a confluence of policy and market shifts has set the stage for this trend to shift. If less land is indeed used for agricultural purposes, Brazil may be on the cusp of a massive restoration of forests on degraded agricultural land.

The key reason higher yields have not historically been associated with restoration efforts in Brazil is due to strong financial incentives to continue expanding agricultural production. These financial incentives are partly the result of the increasing agriculture yields themselves.

Through the late 20th and early 21st centuries, global and domestic population growth pushed demand for food steadily higher as agricultural yields increased. At the same time, yield increases helped to increase farmers’ incomes by decreasing farmers’ per unit costs.

Taken together, these trends created an environment where farmers had compelling financial incentives to use more and more land. (These trends are tied to the so-called Jevons Paradox, where greater efficiency often leads to more total use, not less).

Increased use of land has been exacerbated by two additional, related factors. The first is the role agricultural expansion plays in land grabbing in the Amazon. Land grabbers often graze cattle on cleared forest land as a means of securing title to it. Once they secure title–or sometimes before–they sell the land.

Because cattle grazing is a means to facilitate this process, land grabbers are different sorts of agricultural land users than traditional beef and dairy producers. Instead of taking advantage of yield-enhancing techniques and technologies, land grabbers have a strong interest in using the most land-intensive approaches, since these approaches maximize the amount of land they can claim while minimizing the number of cattle needed to do so.

The second factor–which is also tied to land grabbing–is lax and spatially limited enforcement of policies intended to prevent deforestation under former President Jair Bolsonaro and loopholes in the soy moratorium. Had enforcement of laws been more effective, land grabbing would have been riskier, less attractive, and–consequently–less common, reducing the supply and raising the price of land for agricultural expansion. In practice, land grabbing has helped keep land plentiful and relatively cheap, easing the path for agricultural expansion.

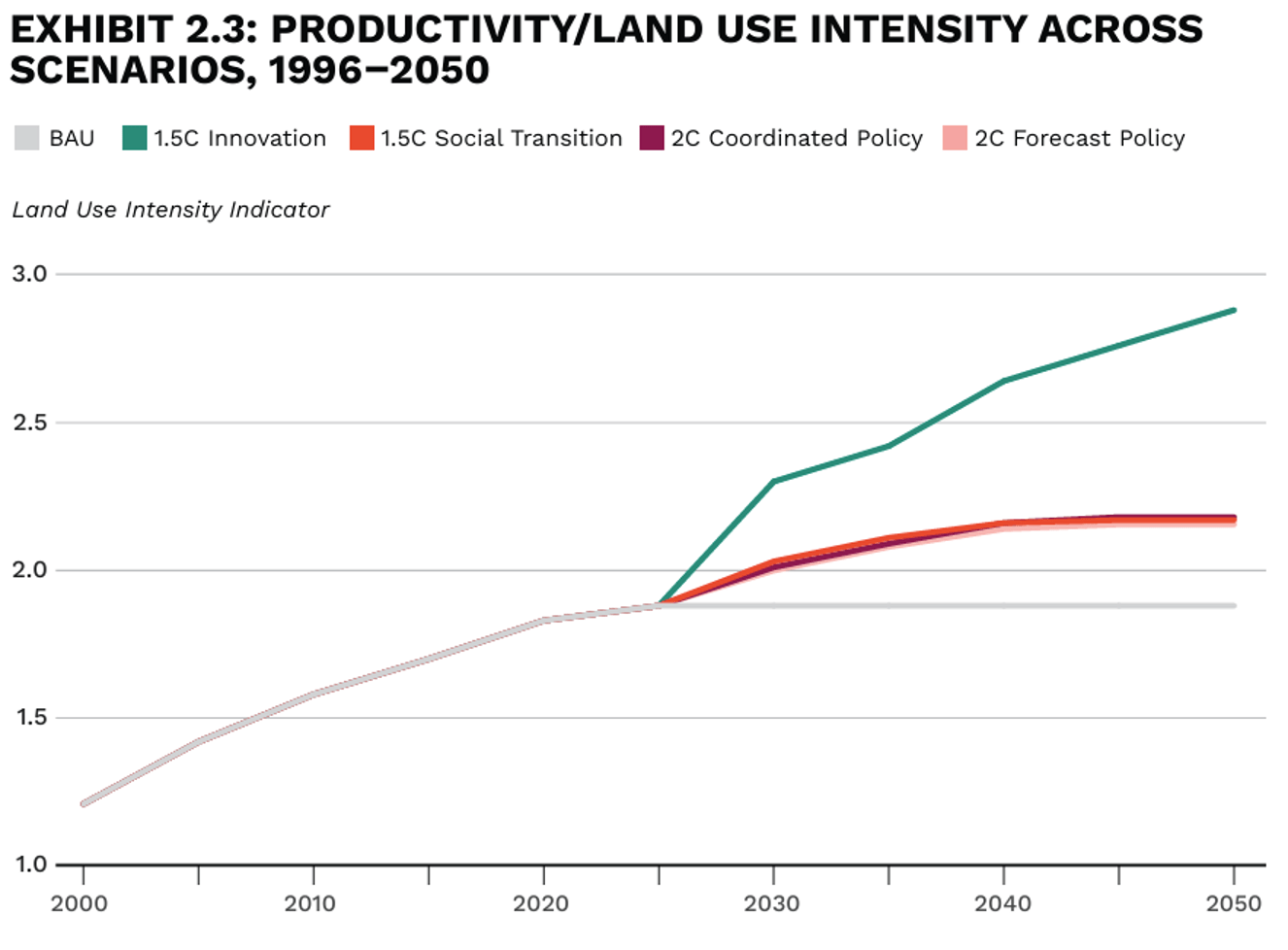

Yields are expected to continue to increase in Brazil, as shown in the graphic below. However, with global food demand also projected to increase further in the coming decades, these trends suggest that, unless incentives change, agricultural land use in Brazil could continue to expand. There is, however, reason to think that there will be a break from past trends and agricultural expansion will slow.

Three key changes are making forest restoration increasingly attractive.

First, a suite of policy changes is discouraging land grabs and encouraging more sustainable, climate-friendly uses of the land. One of President Luiz Inácio Lula da Silva’s first official acts upon his return to office in 2023 was to order resumption measures to combat deforestation in the Amazon and Cerrado that had been abandoned by his predecessor. He has since taken a variety of other measures to combat deforestation, including developing a plan to end illegal deforestation by 2030. These measures should help to disincentivize land grabbing, thus reducing the supply and raising the price of land available for agricultural expansion. Together with other recent policy changes, these changes will increase the appeal of restoration as an alternative to agricultural expansion.

Second, strong, new financial incentives for restoration are emerging in the form of markets for carbon, biodiversity, sustainable timber products, and ecosystem services. These incentives will drive forest restoration toward becoming an economically viable and competitive land-use choice for landowners and businesses.

Finally, innovative financial tools and specialized project developers are poised to turn restoration potential into investable, scalable action. These include blended finance and green bonds, instruments that are already being employed by stakeholders such as BTG Pactual Timberland Group, the World Bank and leading restoration developers re.green and Mombak.

Together these trends alongside increasing agricultural yields are making forest restoration more attractive for investors, policymakers and farmers. The market for forest restoration may actually grow to $141 billion utilizing only the least productive cattle ranching land available today.

Despite the prospect of significant forest restoration potential in Brazil, realizing this potential will not be easy. A number of factors ranging from organized opposition to anti-deforestation measures in Brazil’s Congress and from agricultural interests, immaturity of some markets that would support forest restoration, and other challenges could impede the financial potential of forest restoration.

With the right mix of policy support, financial innovation, and stakeholder coordination, Brazil’s rising agricultural yields could finally support forest restoration—not deforestation. The opportunity is clear. Now the challenge is turning potential into action. For investors seeking scalable, nature-positive returns, Brazil’s restoration market offers an opportunity worth exploring today.