THANK YOU FOR DOWNLOADING

Learn More

If you would like to hear more from Orbitas, including updates on our analysis and resources, please subscribe here.

Soy stakeholders that invest in improving the sustainability and efficiency of their operations, reducing the emission intensity of production, exploring emerging market segments and diversifying revenue streams could see significant opportunities emerge as climate transitions benefit this commodity’s outlook.

Soy stakeholders that invest in improving the sustainability and efficiency of their operations, reducing the emission intensity of production, exploring emerging market segments and diversifying revenue streams could see significant opportunities emerge as climate transitions benefit this commodity’s outlook.

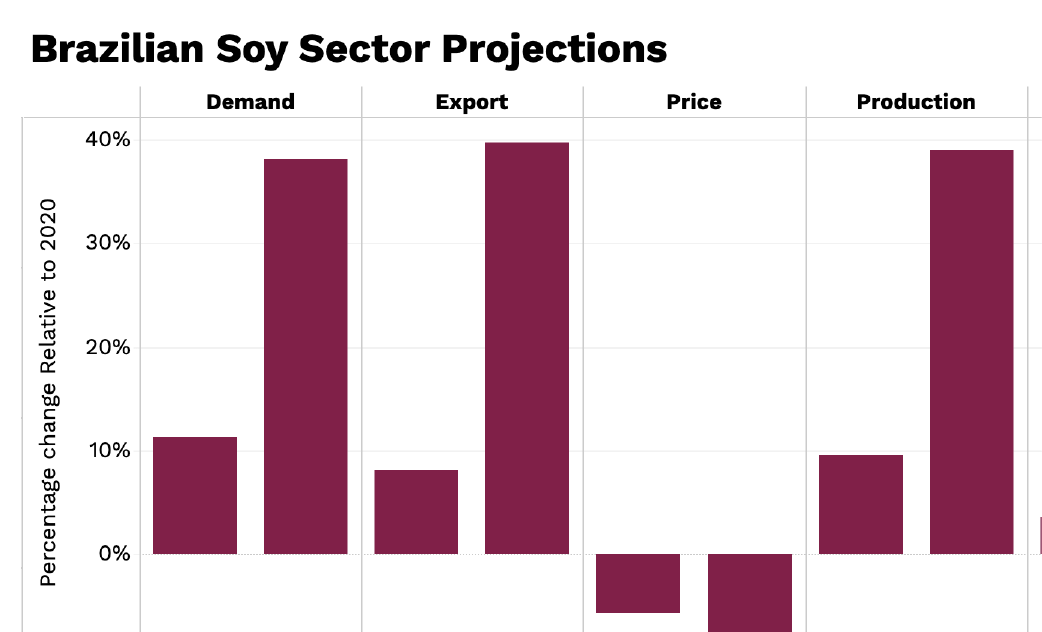

Modeling how different forms of climate action affect Brazil’s soy sector shows that new opportunities for producers and investors are plentiful as climate transitions occur, but material financial risks will also emerge.

%

%

%

%

%

%

2. Land constraints

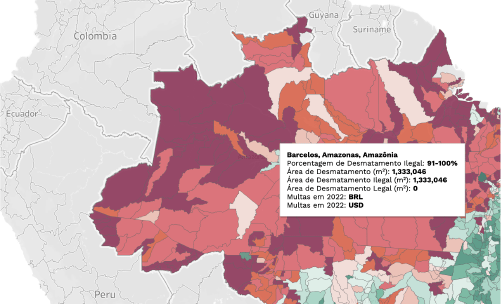

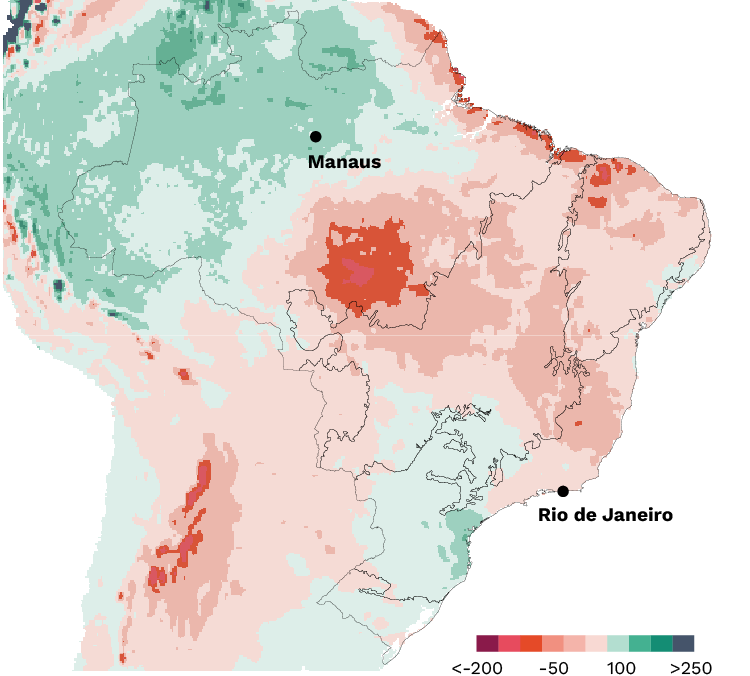

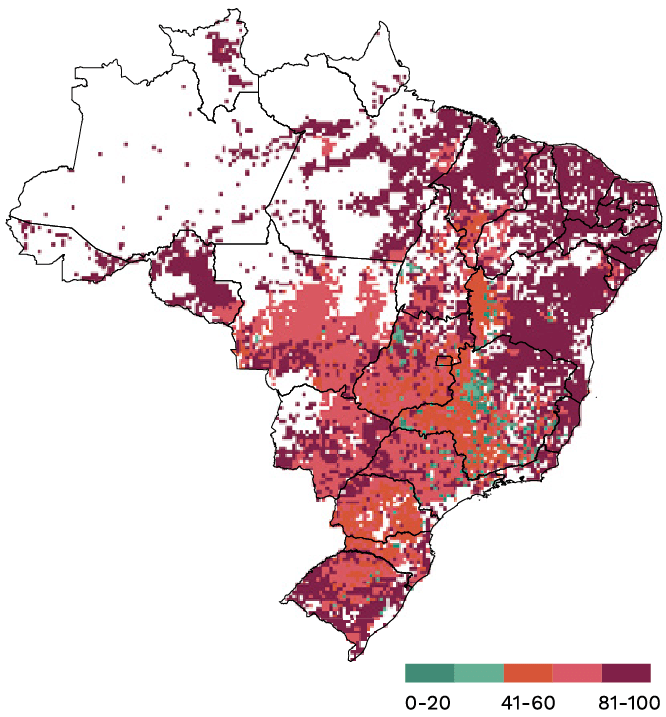

Climate action, land conservation measures and competition for land from the bioeconomy could reduce the availability of affordable cropland land by up to 36 percent between 2020 and 2050.

3. Yield improvements

As business models reliant on high land use and deforestation become less feasible, soy producers can adapt by prioritizing sustainable productivity investments and process improvements to boost the yield on existing land.

4. Modest production growth

Production increases are supported by the implementation of low-cost yield-enhancing technology and sustainable management practices.

5. Accelerating investment

Investment in capital goods, land, advanced technology adoption and improved management practices could increase production efficiency.

6. Soy price declines

Producer prices could decrease due to changing soy demand and lower production costs driven by technological innovation.

7. Consumer preference changes

The demand for ruminant meat feedstocks could decrease under transition scenarios, but the diverse range of downstream soy applications may offer some resilience in international markets.

8. Competitive advantage in exports

Brazil has the potential to grow its competitive advantage for deforestation-free, low-emission and high-yield soy under climate transitions, increasing exports despite a decline in global traded soy volumes.

As Brazil works to meet its own climate goals, it also seeks to earn a reputation as a climate leader on the world stage ahead of the 2025 UN Climate Change Conference COP30 when Brazil will be the host and figurehead for driving global climate action. Additional pressures from international governments, investors, corporates and other actors are shifting the financial outlook for Brazilian soy to pursue a deforestation-free and low-emission future.

As society, the private sector and policymakers become aware of the financial impact of physical changes to Brazil’s economy and agricultural producers mobilize to protect the natural resources that create Brazil’s competitive advantage, the risk of abrupt climate transitions will rise.

Financial risks will increase for many producers, but proactive mitigation of these risks can reduce financial losses while market leaders may even experience financial gains through leaning into climate transition opportunities.

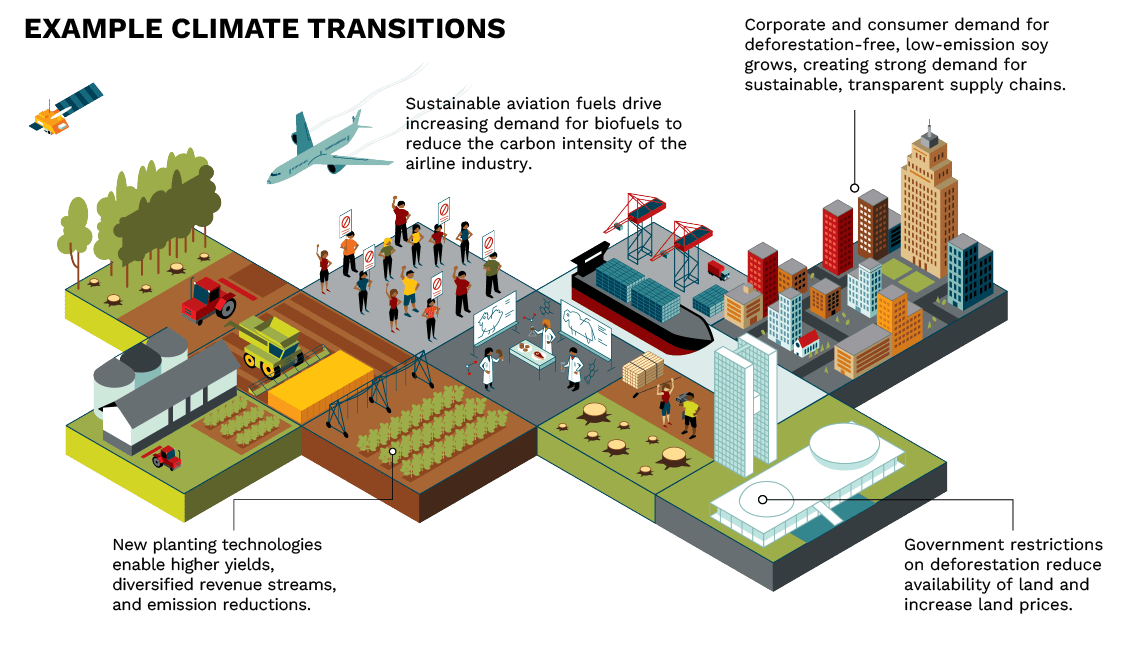

‘Climate change and the actions taken to mitigate its impacts, known as climate transitions, represent some of the largest systemic changes our economies have ever seen. ‘Climate transitions’ refer to shifts in domestic policy, consumer preferences, international regulations, competition driven by technology and other market demands for sustainability that will transform the future of the global economy, especially across the Brazilian cattle sector. Climate transition risks – legal and policy, technology, market and reputation – are all potential pitfalls that can impact performance and are increasingly critical to address, and they all present corresponding opportunities for market leaders.

For Brazil, new anti-deforestation policies, international trade and sustainability standards and corporate or investor net-zero goals all contribute to transitioning the cattle sector towards a new paradigm stakeholders must proactively manage. Learn more about specific climate transitions impacting Brazil’s cattle sector in our report.

We use several different scenarios to showcase the potential impacts that climate transitions may have upon the Brazilian soy sector and reflect how different levels of climate action ambition can create material financial risks and opportunities. To help Brazilian soy producers and investors understand the scale of impacts from climate transitions, this report highlights a plausible reference scenario aligned with keeping global warming below 2° C. This models the impact of forecasted climate policies and actions on the real economy up to 2050, tracing detailed effects on producer prices, crop yields and rates of deforestation. This scenario, the Forecast Policy Scenario, is aligned with the Inevitable Policy Response initiative developed by the UN-supported Principles for Responsible Investment. These principles have been signed by investors with over USD 121 trillion in assets under management.

This report analyzes how different types of climate transitions will impact critical financial outcomes for the soy sector’s producers, investors, buyers and other stakeholders. See the potential outcomes for the Brazilian soy sector across the following:

By 2050, the probability of financial loss from economic shocks common under climate transitions could surpass 60 percent across a significant proportion of Brazilian soy producers at current operating margins.

%

Proactive stakeholders can:

1. Adopt technological advancements and sustainable agricultural practices to increase efficiency.

2. Reduce the emission intensity of production to drive down operating costs.

3. Mitigate exposure to economic shocks.

4. Lower land rental payments.

5. Adapt to meet demand from growing market segments.

6. Earn supplemental income from emerging Brazilian bioeconomy markets.

EMERGING RISKS

The profitability of soy production varies significantly across Brazil, but the least efficient producers who rely on clearing new land to earn profit face the most risk. Without adapting to climate transitions, today’s low performing farms could experience profitability declines of over USD 617, and producers who fail to invest in sustainable management practices and production efficiencies risk financial loss as early as 2030.

SUSTAINABLE OPPORTUNITIES

Brazilian soy farmers can take advantage of a more than 14 percent increase in global soy demand by 2050 due to growing markets for plant proteins, biofuels and non-ruminant meat livestock markets. Investment in yield-enhancing technology innovation could lead to an 83 percent increase in profitability for high performing farms. Producers can also increase resilience through diversifying revenue streams from growing markets driven by efforts to address climate change.

NEW MARKET OPPORTUNITIES

There are growing markets for other land use practices that can transform degraded cropland into profitable assets to diversify revenue opportunities across rural Brazil. Additional revenue streams include agroforestry and non-timber forest products and carbon markets as greenhouse gas prices grow.

Download the report for more details on these new markets and how Brazil’s soy sector can proactively manage risks and opportunities.

See the full report to learn more and check out Orbitas’ suite of online tools to better understand climate transitions and their impacts.