THANK YOU FOR DOWNLOADING

Learn More

If you would like to hear more from Orbitas, including updates on our analysis and resources, please subscribe here.

A 2024 Guide for Companies and Investors in the Land Economy

Policy, regulations and legal rulings from an increasing number of countries and regions now require the private sector to disclose, certify and develop a pathway to reduce emissions from their operations, supply chains and investment portfolios.

Technology, from innovations in reducing livestock methane emissions and advanced agricultural technology to climate smart agriculture in deforestation hot spots, is offering higher efficiency and more resilient alternatives for businesses in the land economy.

Frontrunner companies and investors are proactively reducing their exposure to high-emissions intensity activities in favor of sustainable alternatives.

Reputational concerns around environmental degradation and deforestation, from activist shareholders to concerned consumers, are increasing the pressures businesses face from their stakeholders.

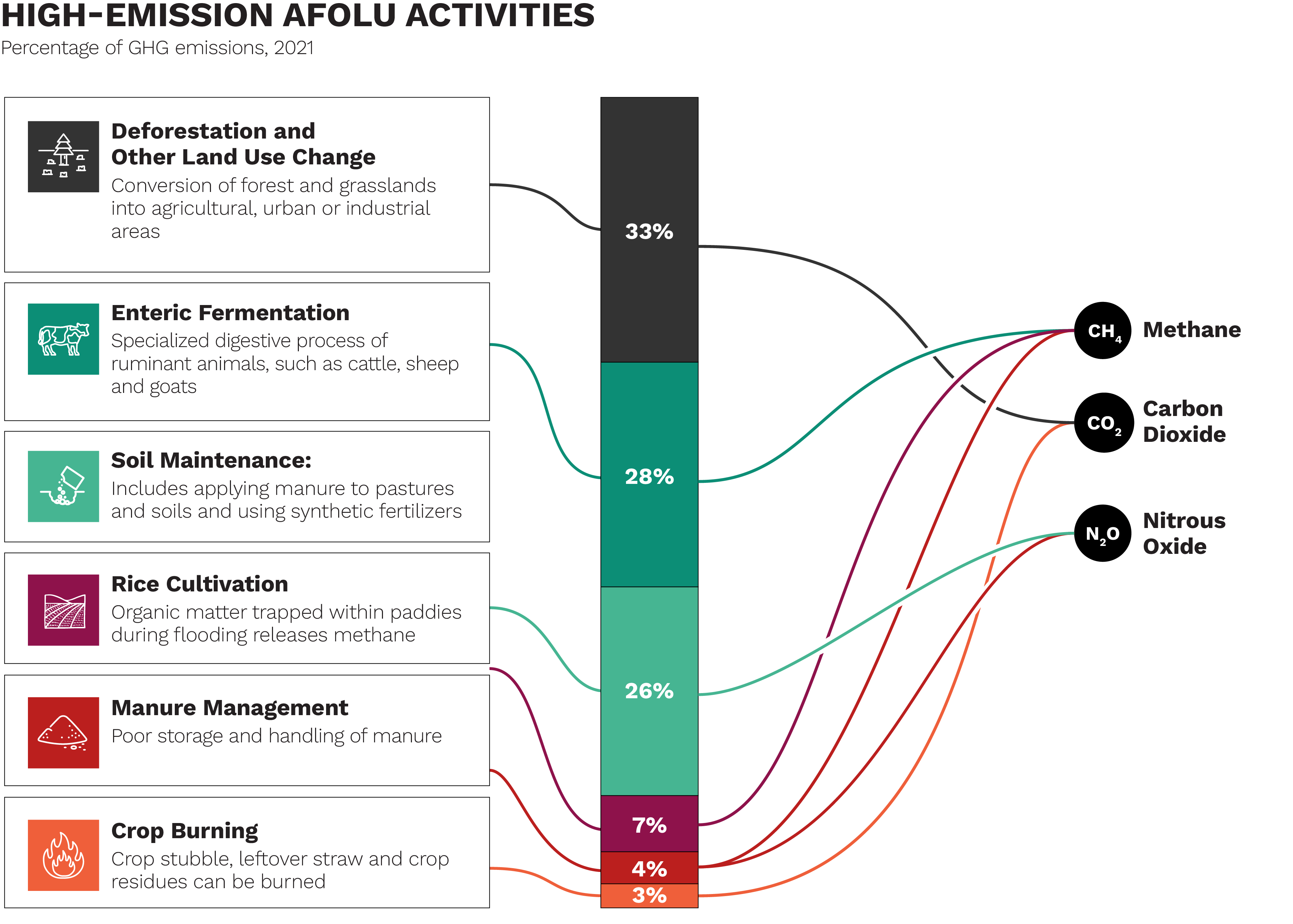

Explore how high-emission activities translate to climate risks and opportunities

However, these threats present opportunities for companies and investors to secure future financial stability by reducing transition risks, and thus, weighted average cost of capital, through exploring emerging markets and diversified revenue streams, adopting developing agricultural technologies and reducing emissions.

Read more about regional and global impacts on the land economy.

Growing supply chain due diligence and sustainability certification requirements are limiting market access to products exposed to deforestation or other environmental degradation. For example, the European Union deforestation regulation to limit EU consumption of products linked to deforestation or forest degradation restricts key commodities linked to deforestation without certifications.

Increasing government commitments to net zero emissions will accelerate incentives for the adoption of sustainable practices and carbon taxes, market restrictions and fines for environmental degradation, amplifying competitive advantages for low emission and deforestation free products. Since the 2015 Paris Agreement, national governments have collectively pledged 92 percent of the global economy to a net-zero emissions target.

Rapidly developing agricultural technology is driving efficiency and creating market leaders by allowing farmers to optimize their operations, reduce waste and lower their carbon footprint. For example, combinations of innovations including precision agriculture, farm automation and robotics are estimated to reduce 71 percent of the emissions from row crops.

Emerging solutions for reducing livestock methane emissions are providing companies and their investors with opportunities to mitigate the impact of carbon tax policies and other emissions-related costs, while reducing substitution risk from low emission alternatives. For example, feed additives and fat supplements for cattle can cut cattle methane emissions by 10 to 40 percent, while natural solutions such as seaweed can cut these emissions by up to 80 percent. Other solutions include pasture-based rotational grazing and the breeding of larger, healthier cattle.

Growing consumer preferences for sustainable goods is rewarding emission reduction practices, and companies and their investors who fail to integrate emissions reductions and monitoring along their supply chains may lose their competitive advantage. For example, sustainable products achieved a more than a 35 percent higher five-year growth rate compared to their conventional counterparts.

Downstream companies are increasingly mandating sustainability commitments from their suppliers to mitigate the reputational risk associated with deforestation, which limits market access for deforestation-linked suppliers. For example, 60 percent of 350 FLAG sector companies most exposed to palm oil, soy, beef, leather, timber, pulp and paper now have no-deforestation policies, and actions by companies such as Unilever, Proctor & Gamble and Nike are leaving non-compliant producers with limited avenues.

Loans and investment policies are increasingly conditional on sustainable practices including climate-smart techniques and reductions in emission intensity. High emission companies are seen as riskier than lower emission competitors, which leads to differences in the weighted average cost of capital. Strict standards for borrowers from public lenders such as the European Investment bank, the World Bank and the International Fund for Agricultural Development and commercial lenders such as Rabobank, are aiding the adoption of sustainable practices.

Carbon markets and nascent biodiversity markets are offering revenue diversification opportunities, and are expected to grow to around USD 250 billion and USD 69 billion respectively by 2050. Nature-based solutions may present a more reliable future for low margin producers and include afforestation and deforestation, clean energy initiatives, carbon sequestration, forest and nature conservation and restoration.

Growing scrutiny and access to monitoring technologies are driving pressure on companies and investors to accurately report on, and meet, climate commitments, or risk reputational damage and regulatory scrutiny. Almost 60 percent of the world’s largest publicly traded companies committed to net zero emissions by at least 2070. Sustainability leaders in the FLAG sector include Unilever, Danone and Nestle.

Tech-enabled advancements like satellite monitoring along supply chains, are amplifying the reputational risks faced by companies and investors that fail to adopt deforestation-free and low emission practices, risking brand damage and divestment. Companies such as Unilever and Danone are leading through proactive reporting, updates and mandates from their supply chains, with Unilever’s Sustainable Living brands accounting for 75 percent of the company’s growth in 2020.

The rapid spread of information and rising internet access globally, around 7.9 billion people by 2029, are amplifying negative and positive brand value impacts, with 30 percent of a company’s market value impacted by reputational events. Companies that disclose environmental impacts and adopt rigorous actions to mitigate climate risks will strengthen their brand resilience, and those that fail to risk both reputational and financial damage.

Read more about climate transition risks

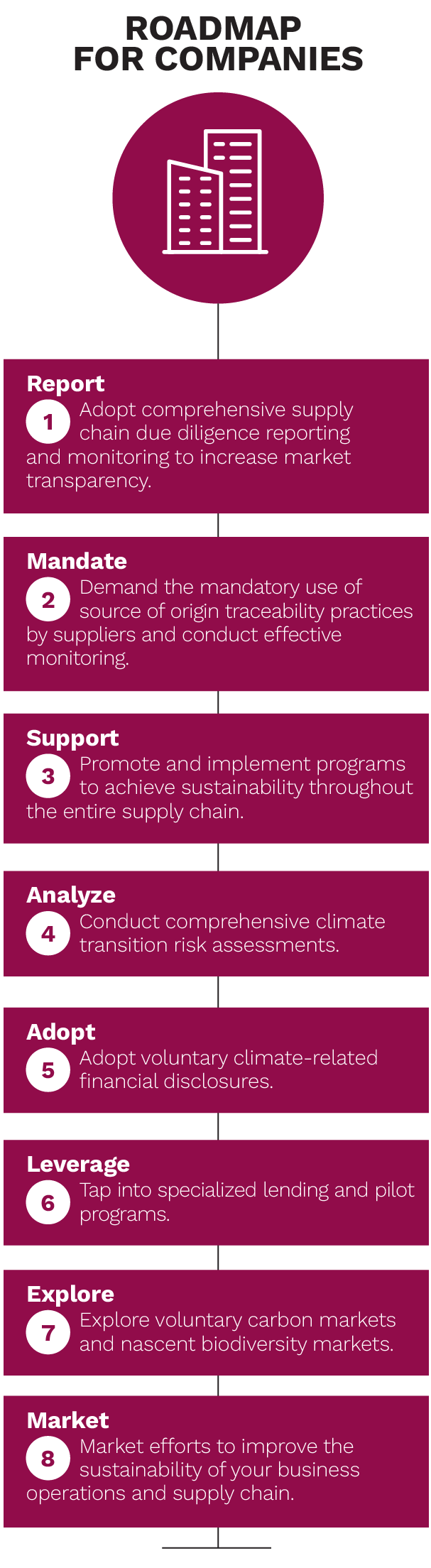

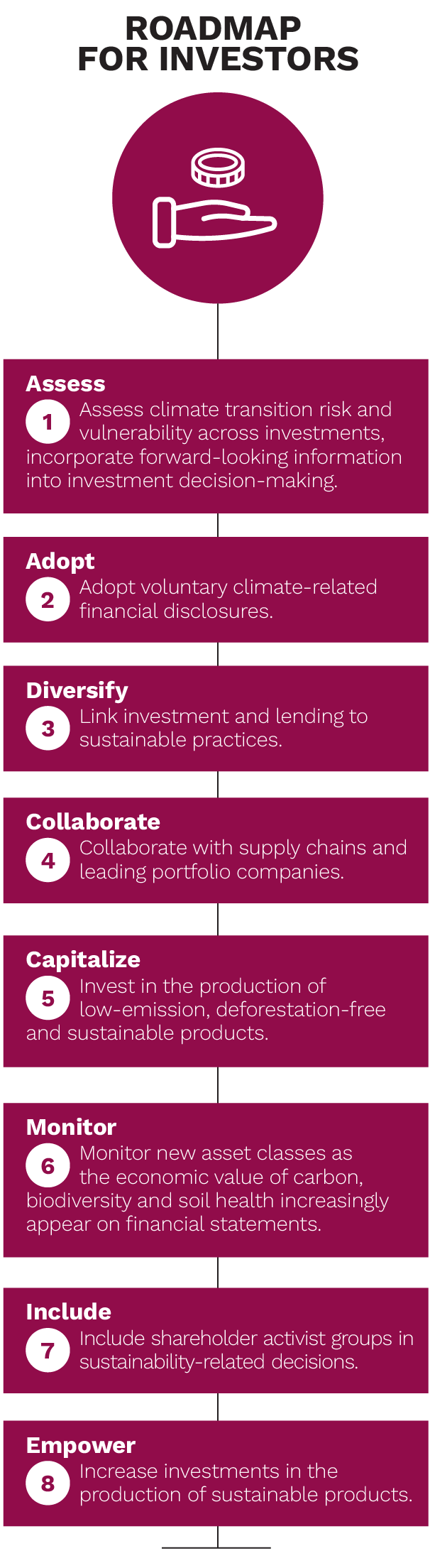

Go deeper on the recommendations and potential benefits.