Author: Kyle Saukas

Investor Perspectives On Closing Brazil’s Climate Finance Gap

Brazil’s Climate Finance Gap – The agriculture transition can successfully protect nature, support a wide range of stakeholders and drive investor returns

Increasing capital mobilization for nature-based solutions and climate-smart agriculture can spark a transition in Brazil that would not only cut emissions but also benefit Brazil’s farmers, businesses, local communities and Indigenous Peoples. That was the main takeaway from our workshop at Climate Week NYC where investors, entrepreneurs and other stakeholders joined us to discuss closing Brazil’s climate finance gap.

With Brazil establishing itself as a climate action leader and serving as president of the G20 Summit this year and COP30 in 2025, finance for climate solutions will be a major topic as Brazil seeks to drive resilience and capitalize on significant growth opportunities in the land economy. Efforts to raise and deploy capital to reduce emissions from the forest, land and agriculture sectors, Brazil’s largest source of emissions, will likely shape the country’s agriculture sector in the coming decades.

Brazil’s agribusiness sector faces several challenges from a long list of materializing climate risks. Still, efforts to increase and deploy new climate finance in the country have the potential to rapidly scale climate-smart agriculture and nature-based solutions that can mitigate risks and position Brazil to lead in a low carbon future. Our recent analysis of Brazil’s cattle and soy sectors finds the adoption of emissions pricing, land constraints, commodity price fluctuations, changes in consumer preferences and other trends are set to impact Brazilian agribusiness significantly. How Brazil navigates these trends will likely depend on a variety of factors, not least of all targeted investment in the country’s sustainable agriculture and the bioeconomy.

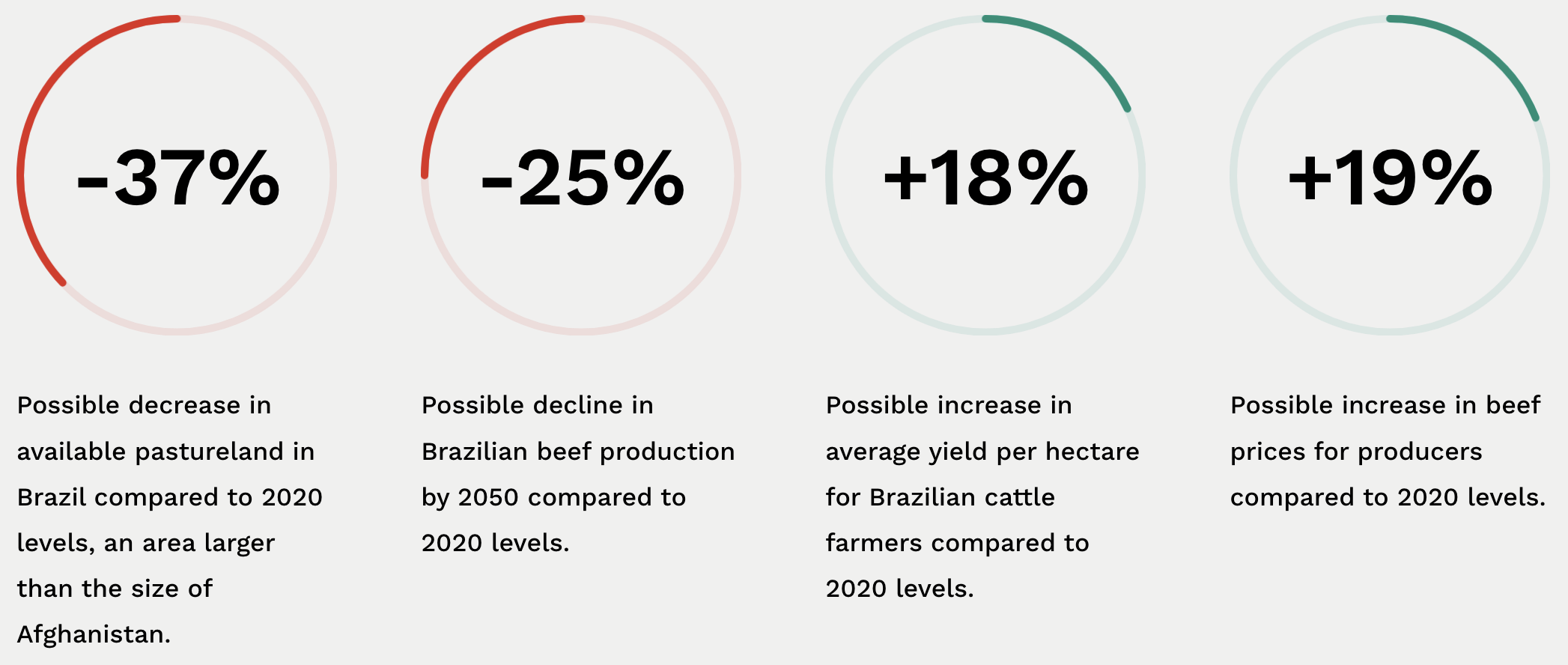

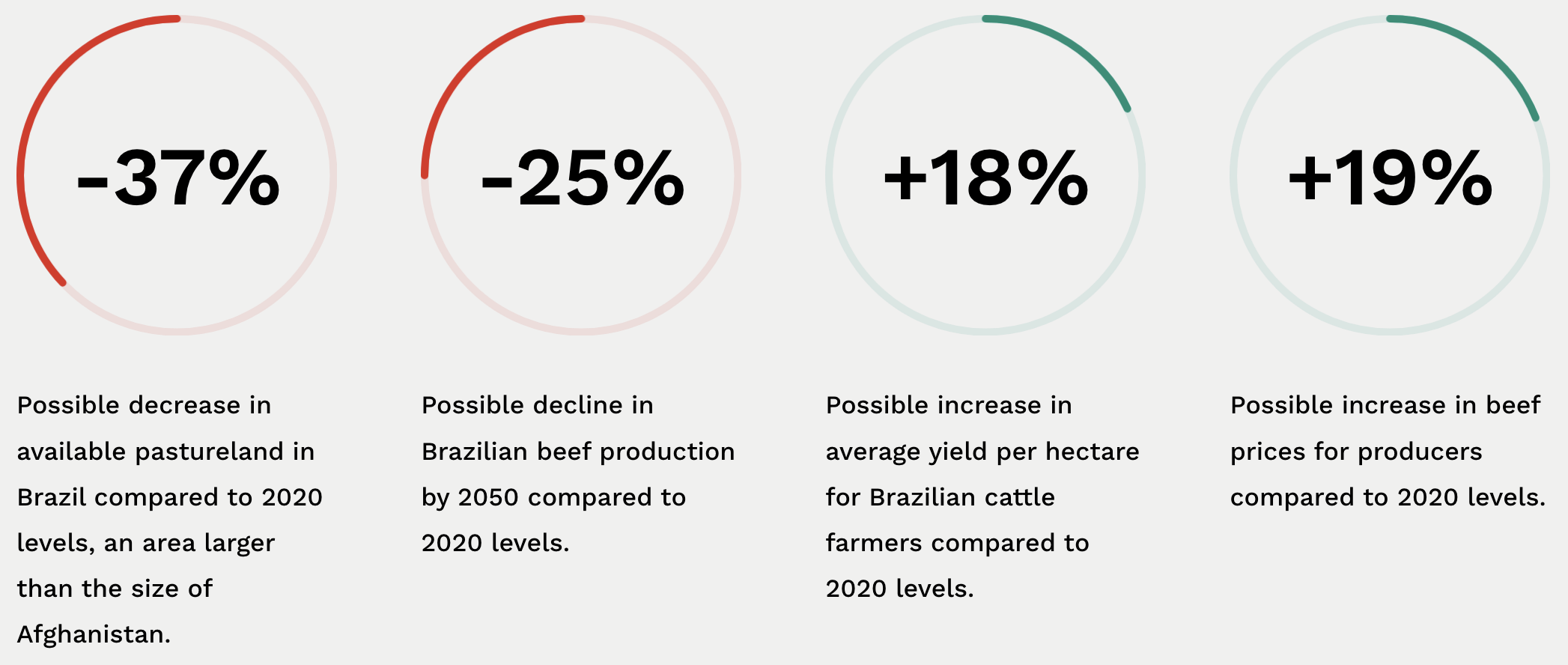

2050 Impacts of Climate Transitions on Brazil’s Cattle Sector

SEE OUR BRAZIL CATTLE REPORT

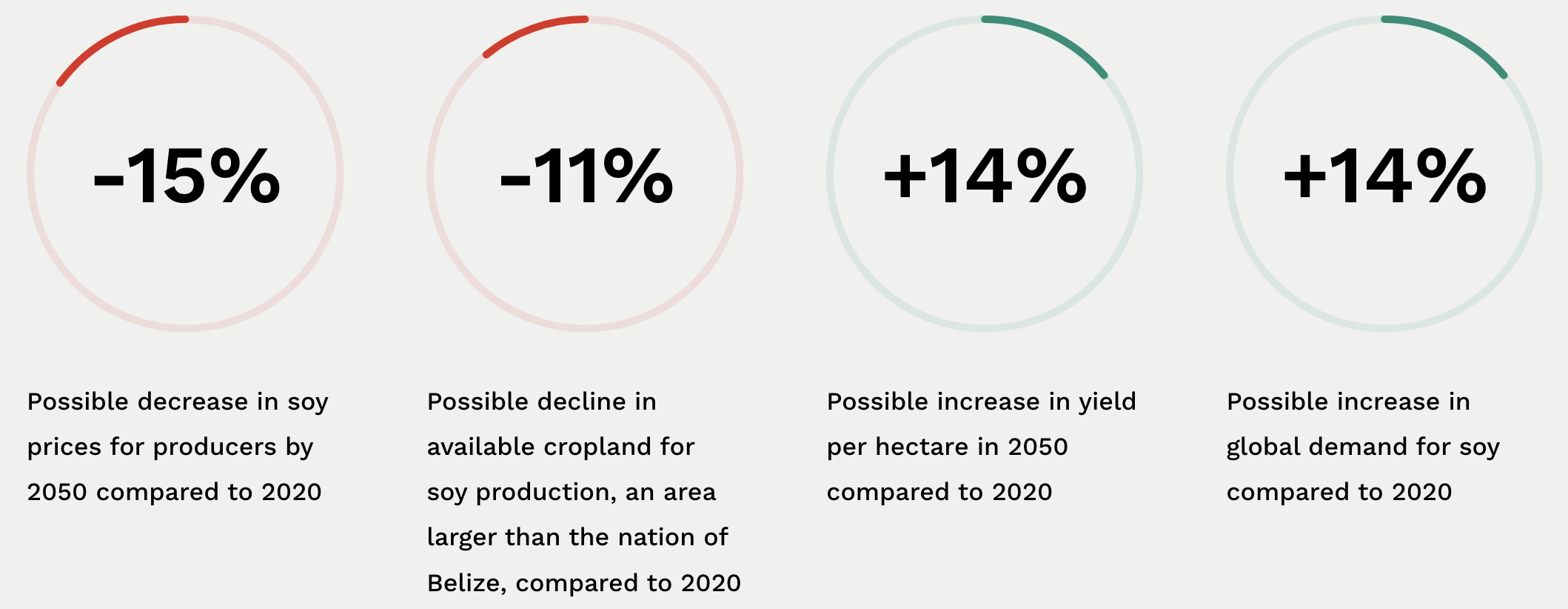

2050 Impacts of Climate Transitions on Brazil’s Soy Sector

SEE OUR BRAZIL SOY REPORT

SEE OUR BRAZIL SOY REPORT

At our Climate Week NYC event, we discussed leading efforts to mobilize capital for sustainable agriculture and nature-based solutions that could improve financial resilience, reduce emissions and create opportunities for Brazilian farmers and investors. Compiled below are the main participant insights on closing the financing gap to fund Brazil’s investments in sustainable agriculture and Brazil’s bioeconomy in the run-up to COP30 and beyond.

Attendees at the Orbitas Climate Week NYC Workshop

Emerging financial mechanisms and capital mobilization for new and transitioning asset classes are key to financing the climate transition

Several financial mechanisms and strategies can incentivize climate-resilient practices, especially for farmers and local communities.

- Blended Finance: Using blended finance can combine different types of capital to reduce investment risks. Some nature-based solutions projects are at their early stages and exceed the risk appetite of traditional financial institutions, so blended finance can be crucial for scaling nascent industries. Utilizing catalytic capital investment structures by partnering with non-governmental organizations (NGOs), philanthropies or governments can help derisk investments.

- Patient Capital: The forest, land and agriculture sectors often require patient capital since they usually operate on longer return timelines. This is particularly true for ecological restoration, afforestation, restoring degraded land and sustainable agriculture. Long-term investors and pension funds are well-positioned to pair long-term investments with long-term rewards.

- Risk Pooling: Conducting due diligence on small-scale investments can be time-consuming and limit the scalability of nature-based solutions and sustainable agriculture initiatives at large institutions. By pooling the risk across a wider variety of investments and centralizing due diligence, investors can provide significant financing while achieving higher diversification and lowering risk.

Cross-sector collaboration needs to include a wide range of stakeholders

Collaboration between financial institutions, governments, NGOs and local communities is vital to implementing sustainable practices and increasing investment. In particular, collaboration should include:

- Collaboration with Indigenous Communities: Involving Indigenous Peoples and Amazon communities in investment discussions is important to incorporating vital knowledge and practices that could enhance the quality, durability and sustainability of projects.

- Government Support: Governmental policies and regulatory frameworks are critical in supporting sustainable business models. That is in large part because financial institutions and companies need regulatory certainty to effectively manage risks, particularly preventing deforestation and land degradation and incentivizing climate-smart solutions.

- Buyers Buying Into Sustainability: Corporate procurement policies with demand guarantees for sustainably produced goods can significantly drive new financing for Brazil’s agricultural transition. With corporate buyers increasing their climate commitments and suffering harsher reputational repercussions from association with deforestation, this trend has been materializing rapidly. Buyers hold significant sway with producers across Brazil and can send a strong market signal to investors that market demand for sustainably produced commodities will remain resilient, increasing the likelihood of new investments.

Emerging sectors and technologies have untapped potential

Participants emphasized that emerging sectors and technologies could be key to Brazil’s ability to capitalize on climate opportunities with sufficient support and investment.

- Agroforestry and Regenerative Agriculture: These sectors have significant growth potential and provide opportunities for companies and banks to channel international capital into conservation and ecological restoration projects. Collaboration between private, public and civil society actors is key to attracting and deploying new capital.

- Growing Bioeconomy Opportunities: Brazil’s role as lead of the G20 has led to the adoption of the first set of principles for the bioeconomy ever adopted at a multilateral level. President Lula’s administration aims to establish the bioeconomy as a cornerstone for attracting future green investment for Brazil. Deploying new capital at the ground level for the bioeconomy remains challenging, especially for community-owned entities or cooperatives, but a growing number of investment opportunities are emerging across Brazil.

- Technology and Innovation: Innovations in credit analytics and traceability solutions for supply chains have the potential to support farmers in selling green products, increasing transparency and improving the investment landscape in Brazil. Other key technologies that have significant potential include precision agriculture, farm robotics and automation, crop rotation and no-till farming, among many others.

Stakeholders have to contend with lack of a trust and nascent industries

For investment in nature-based solutions and sustainable agriculture to scale up, stakeholders need to overcome some barriers and challenges.

- Lack of trust and familiarity: Both farmers and investors have expressed a lack of trust in new sustainability solutions, which has slowed adoption. Efforts to provide knowledge-sharing platforms, along with case studies that highlight success in this area, are crucial to building trust and familiarity, which would inspire investor confidence.

- Immaturity of the bioeconomy: Despite the high potential of Brazil’s bioeconomy, many companies are in the early stages of investing in this space. This has limited the sector from having access to traditional finance. Standardized frameworks and roadmaps for new industries like regenerative agriculture could guide investment and reduce risk.

Scaling up investments ahead of COP30

In the lead-up to COP30, scaling investments quickly is crucial to Brazil’s ability to not only mitigate rapidly materializing climate risks but also to capitalize on emerging climate opportunities that could bring about tangible economic growth.

- Expanding investment: There is a need to scale up successful models and accelerate the deployment of capital for sustainable agriculture and bioeconomy projects in Brazil, especially in rural and Indigenous communities.

- Building investor confidence: Demonstrating successful projects can accelerate trust building in the long-term viability of nature-based solutions and sustainable agriculture projects, which is key to unlocking a greater influx of investment.

Looking Ahead to COP30

With Brazil’s economy changing amid climate-related transition risks and opportunities, sustainable practices and nature-based solutions present investment opportunities that can diversify revenue streams for local communities and drive returns for investors. Integrated farming systems, biodiversity markets, carbon markets, non-timber forest products, deforestation-free cattle products and ecological restoration are just some examples of investment opportunities that can provide benefits for both the climate and the country’s economy.

The risks of inaction are too great to ignore. Orbitas analysis of Brazil’s cattle and soy sectors shows that without taking action to adopt more sustainable production practices, most producers could face an 80 percent and 60 percent chance of profitability loss respectively.

But the opportunities these transitions present are equally as impressive with a projected 88 percent potential increase in capital investment in Brazilian agriculture by 2050 even in a world that limits global temperature rise to below 2°C — a USD 157 billion opportunity. For producers that receive investment and support to transition to sustainable agricultural practices, climate transitions can be an opportunity for significant growth. Cattle producers could see prices rise 19 percent for sustainably produced beef, and soy producers could benefit from a global demand rise of 14 percent compared to 2020 levels.

Workshop participants agreed that closing Brazil’s climate finance gap presents an opportunity for Brazil’s economy to capitalize on the opportunities presented by climate leadership. As Brazil prepares to host COP30, there’s an opportunity to recruit billions of dollars in new investments and to build resilience across Brazil’s land economy as climate risks materialize. These transitions will drive new risks, but according to workshop participants and Orbitas analysis, those who lean into cross-sector collaboration and innovative financial mechanisms can take advantage of the new opportunities of climate finance and transitions across Brazil.