THANK YOU FOR DOWNLOADING

Learn More

If you would like to hear more from Orbitas, including updates on our analysis and resources, please subscribe here.

Author: Alec Estabrook

By 2050, Brazil’s cattle sector will face accelerating financial impacts related to material risks from climate transitions, making business-as-usual investment and production practices untenable. While sector stakeholders can anticipate these risks (and new opportunities) posed by climate transitions, most risk managers are still unfamiliar with this new breed of climate impacts.

Analysis utilizing conservative assumptions of climate action within popular financial models amongst today’s investor class shows these risks could drive a 25 percent reduction in Brazilian cattle production, a 37 percent loss of current pastureland and an increase in the probability of financial losses for many Brazilian cattle producers to at least 80 percent. Understanding this new class of climate change risks known as “Climate Transitions” is vital for maintaining future competitiveness for the private sector and mitigating risk for capital providers.

Climate change poses unprecedented financial risk to the global economy, with physical risk events estimated to cost between USD 1.7 – 3.1 trillion per year by 2050. This estimate, however, fails to anticipate the cost of responding to climate change, the actions taken by governments, corporations, financiers and customers to transition to a low-carbon economy.

While climate transition risks are becoming more familiar in some sectors, risks to the agricultural sector are commonly viewed in terms of physical events only. Producers today look for innovative strategies to manage shifting precipitation patterns, rising air temperature and other symptoms of the changing climate. Yet, developing strategies to remain competitive in a market responding to climate action is novel.

Poor understanding of the food and agricultural sector’s role in global greenhouse gas (GHG) emissions and available solutions has allowed it to avoid the same level of societal and political pressure directed towards the energy sector. Recent analysis shows agriculture, forestry and land-use change are responsible for 27 percent of global GHG emissions from 2000 to 2020. Rapidly accelerating calls for climate action will materially impact the sector. Brazil’s cattle sector is the target of much attention because of its significant level of emissions, its impact on carbon-rich biomes across Brazil threatened by nature loss and its critical importance for Brazil’s economy.

For investors, producers, policymakers and all the companies along the value chain dependent on a resilient Brazilian cattle sector, understanding the four forms of climate transition risks and how to manage them is crucial for future economic success.

Domestic Policy Action: While deforestation plays a role in agriculture globally, parts of the Brazilian cattle sector have traditionally relied on the practice to cheaply create new pastureland. These practices have led to an estimated 12 million hectares of deforestation between 2008 and 2021.

To curb further expansion, Brazil’s government has committed to end deforestation by 2030. The Prevention and Control of Deforestation in the Amazon (PPCDAm) and other comprehensive policy solutions have recently been signed into law to provide substantial investment in law enforcement, tracing and satellite monitoring to prevent deforestation from occurring. Enforcing Brazil’s past and new laws to prevent deforestation for cattle ranching is having a positive impact by reducing the conversion of nature into new cattle pastureland.

Additionally, Brazil is making investments to disincentivize cattle ranchers from pursuing deforestation by making alternative production practices more lucrative. Brazil’s national bank (BNDES) aims to restore 6 million hectares of forests through economic incentives for conservation and sustainable forest management reducing the existing supply of pastureland.

Brazil is also seeking to implement policies to attract more private capital that incentivizes producers to avoid deforestation. One example of this is in the potential development of a regulated Brazilian carbon market. Despite approval in the Chamber of Deputies, Brazil’s lower legislative body, at the end of 2023 the future of a Brazilian state-operated carbon market was still uncertain, with debate over scope and methodology expected to dominate much of the 2024 legislative session.

With Brazil’s cattle sector responsible for an estimated 300,000 mmt CO2e in 2020, the inclusion of agriculture in a regulated Brazilian carbon market poses substantial risks to stakeholders tied to deforestation with substantial increases in production costs. On the other hand, producers and investors adopting nature conservation or restoration measures provide new revenue opportunities.

While the regulated market is still under debate, many Brazilian states are already pursuing deals in the voluntary carbon market. Their efforts are aimed at securing a high enough price on the carbon stored within their natural resources to fund conservation, restoration and sustainable agricultural programs from private sector buyers of carbon credits. It is difficult to predict the future value of Brazil’s carbon markets, but they could be worth billions of dollars in the near future and incentivize a shift from cattle production to other land uses.

International Policy Action: Legal and policy risks do not emerge from within Brazil alone. The European Union’s Regulation on deforestation-free products (EUDR), and the proposed US Fostering Overseas Rule of Law and Environmentally Sound Trade (FOREST) Act would penalize companies importing cattle-based goods from Brazil connected to some types of deforestation.

Responsible for an estimated 12 million hectares of deforestation between 2008 and 2021, cattle imports from Brazil will be heavily monitored under both regulations. Failure to comply risks fines proportionate to the environmental damage inflicted, confiscation of revenues gained as well as the relevant commodity and temporary exclusion from the EU market. With an estimated 50 percent, or USD 1.66 billion, worth of EU cattle imports from Brazil associated with deforestation, parts of the Brazilian cattle sector risk losing access to a market worth USD 3.26 billion.

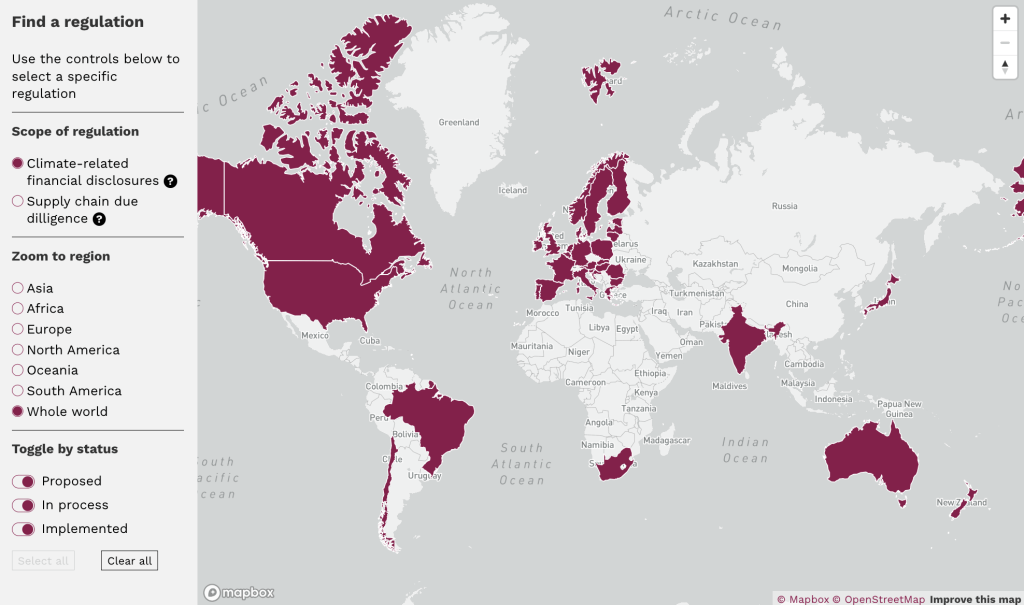

See more about climate-related supply chain due diligence rules using our Financial Regulations Map

Improved Sustainability Monitoring: Agricultural value chains are often complex, involving a range of multi-level players before reaching downstream retail markets. Brazil’s cattle sector is no different, relying on a decentralized and sometimes complex network of diverse stakeholders that has made monitoring for deforestation difficult.

To comply with anti-deforestation regulations, new cost-effective satellite imaging solutions have made it easier to monitor supply chains. High-resolution imaging, real-time monitoring, automated detection algorithms and integration with existing geospatial datasets have allowed law enforcement to detect small-scale deforestation activities associated with cattle farming, in near real-time, enabling rapid response to violators and reducing the need for lengthy investigations.

Monitoring efforts from DETER and PRODES between 2000 and 2015 are estimated to have saved more than 65 million hectares of the Amazonian rainforest, exposing cattle farmers continuing to violate deforestation guidelines to prosecution, fines and loss of market access while threatening reputational damage to downstream traders exposed for their reliance on compromised suppliers.

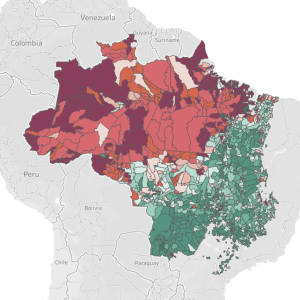

Try out the Orbitas Illegal Deforestation Risk Analyzer to learn where investors face outsized risk from deforestation in their supply chains

New Competition: Despite slowing sales in recent years, the cell-cultivated and plant-based meat industries have captured the interest of consumers across developed economies. With a combined global market size valued at USD 4.64 billion in 2022, products from both markets are still in the process of maturing as cell-cultivated products face limited market access.

Growing demand for more sustainable products may provide a path forward as 56.9 percent of surveyed Brazilian consumers indicated they would be willing to eat cultured meat as a replacement for conventionally produced beef. The growing abundance of alternatives has coincided with rising public scrutiny for cattle-related deforestation, providing consumers the opportunity to assuage their concerns while enjoying similar products.

Improving Production Efficiency: Despite being the world’s second-largest producer of beef products, Brazilian cattle ranching often remains relatively unproductive. As of 2018, the estimated ratio of hectares of pastureland to head of cattle produced was one-to-one.

Sustainable intensification of cattle systems through rotational grazing, silvopastoral systems, and integrated crop-livestock forestry (iCLF) could maximize forage utilization and improve soil fertility. When combined with ag-tech solutions like precision-ag monitoring and improved herd genetics, which offer improved cattle health and meat yield, sustainable intensification could multiply pasture productivity by up to 2.5 times.

These efficiency improvements can be compounded by the increased rate of carbon sequestration that improves pasture biodiversity and soil health, reducing GHG emissions while reducing deforestation pressure on existing forests. Producers capitalizing on these strategies may increase their profitability and outperform stagnant competitors.

Loss of Market Access: As previously mentioned, consumers are calling for more sustainable products. In today’s world of rapid formation dissemination, consumer awareness of the environmental and social cost of agriculture is growing.

This shift in consumer preferences has placed substantial pressure on the Brazilian cattle sector leading some downstream retailers to restrict market access for all Brazilian beef products. Brazil’s largest meatpackers have each faced significant repercussions following investigations uncovering links to cattle produced on illegally deforested and Indigenous lands losing customers across Europe. Marfrig in particular lost access to their largest customer – Nestle after an investigation and has since sold most of its Amazon-based slaughterhouses. Marfirg had a potential USD 200 million sustainability target-focused loan from the Inter-American Development Bank deal fall apart due to the inability to reconcile environmental targets. JBS has been sued by the US state of New York over potentially false sustainability claims.

Increased Cost of Capital: Growing inclusion of climate risk reporting and environmental, social, and governance (ESG) criteria by major institutional investors and asset managers in recent years has increased shareholder attention and scrutiny on companies operating in environmentally sensitive sectors. In the hopes of avoiding reputational damage from environmental impacts, seven major European investment firms with more than USD 2 trillion in assets under management threatened to divest from Brazilian cattle producers in 2019 to avoid the risks of surging Amazon rainforest deforestation.

Divestiture efforts often follow shareholder resolutions and engagement, activities that increase the risk of reputational damage to companies failing to respond. A negative reputation can negatively impact the future cost of capital and the terms placed upon a company in future loan agreements, bond issuances, terms for supplier finance and other financial vehicles necessary for stakeholders across Brazil’s cattle value chain.

Buyer Sustainability Standards: While retailers, wholesalers and traders often face the brunt of public scrutiny for environmental degradation, their upstream suppliers are typically responsible for the deforestation associated with agricultural supply chains. In response to growing concerns about climate change driven by consumers and its impact on agricultural production retailers, wholesalers and traders have begun to implement a range of new environmental standards.

This increases the scrutiny Brazilian cattle suppliers face as efforts to prevent deforestation mount. Traders are increasingly adopting deforestation-free requirements, requiring suppliers to trace, monitor and certify their cattle were produced on pasture free from deforestation (made easier by the technology improvements mentioned previously). Failure to comply with trader requirements risks market access: since there is no direct-to-consumer market, producers rely on traders to bring their products to market.

Hoping to avoid the reputational and market access risks of association with a major deforestation event, downstream corporate players are increasingly willing, or forced by regulation, to pay a higher price for sustainably produced cattle goods. Major corporations like Walmart, McDonalds and others have enacted requirements primarily in the form of increased traceability, enabling retail entities to trace individual beef across various stages of production, each certified to be free from deforestation exposure.

To learn more about these risks and their potential impact on investors in Brazil’s cattle sector see our latest report available below, and try out the suite of Brazil-focused financial analysis tools we’ve developed to help stakeholders understand how climate transitions will impact the sector.